Welcome to our comprehensive tutorial on using the AanyaHR payroll system. This guide is designed to walk you through each step required to successfully run a Regular payroll, ensuring that all your employees are paid accurately and on time. Whether you are new to our system or looking to refresh your knowledge, this tutorial will provide you with all the information you need.

From entering employee details to calculating deductions and government contributions, our software simplifies each aspect of the payroll process. We'll cover the Seven key steps involved in creating a payroll run:

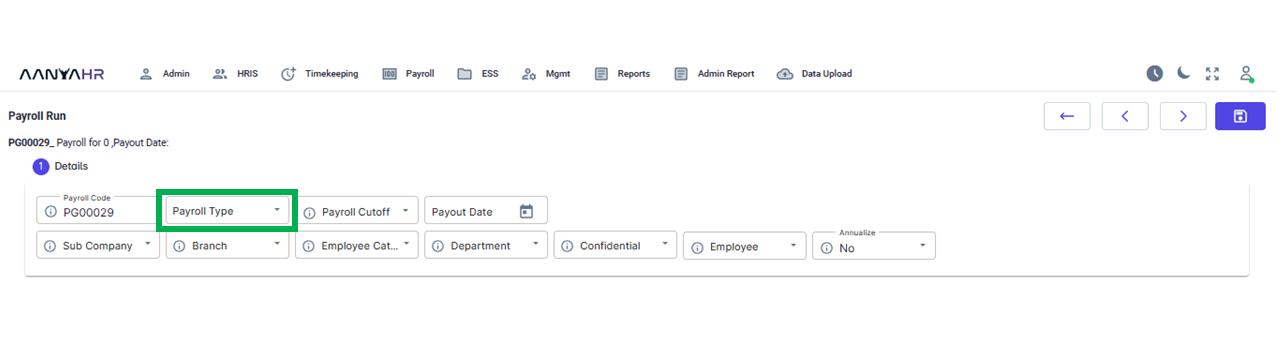

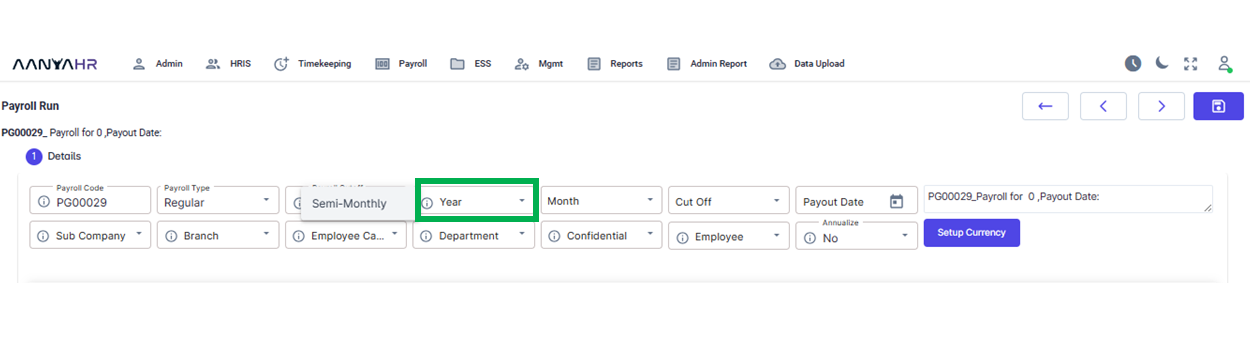

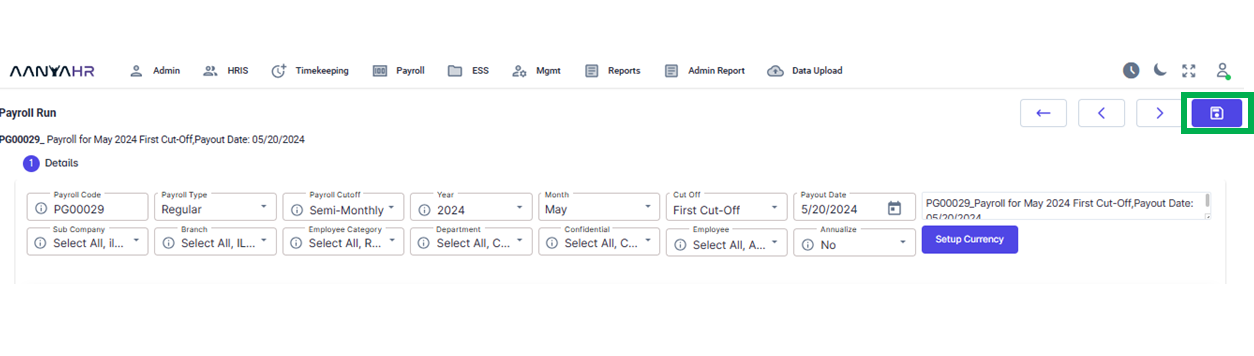

Step 1: How to set up Details?

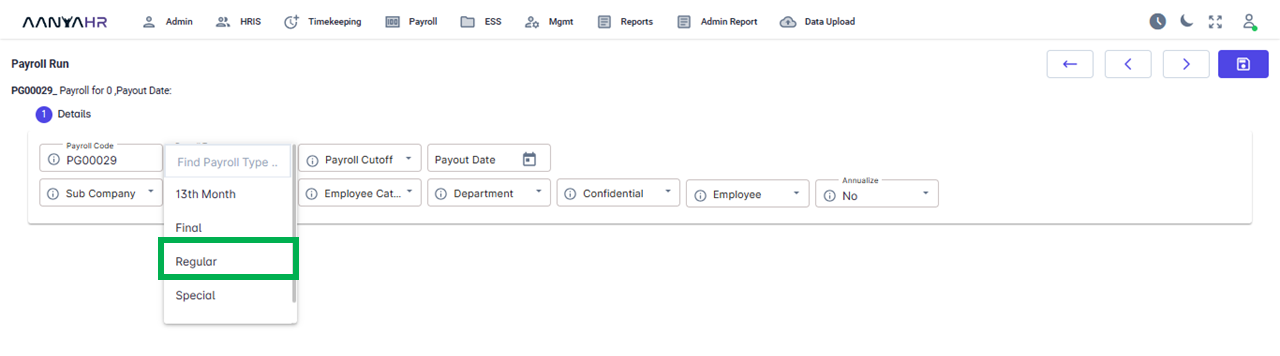

A. Under Payout Type, Select Regular.

The Payout Type will show the list of Pay out that you can make. For this tutorial, we are running a "Regular Payroll". So we should select "Regular"

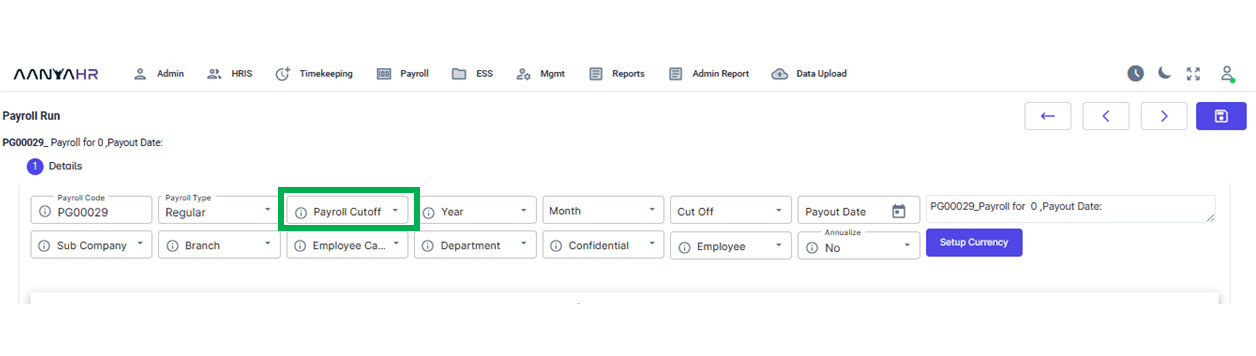

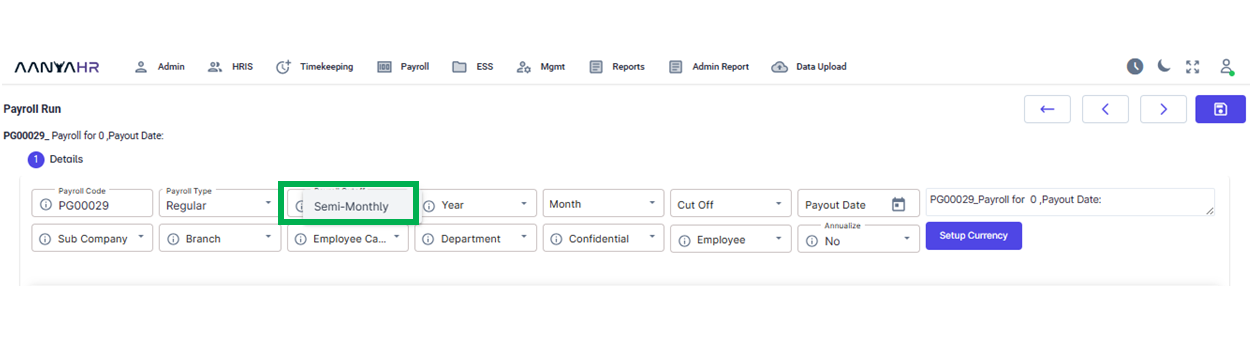

B. Under "Payroll Cutoff", select the "Payroll Category" you wish to run:

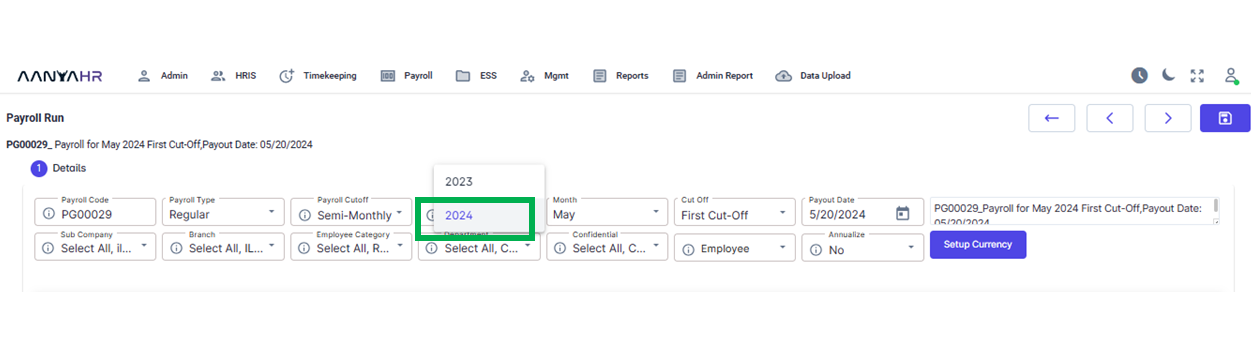

C. For the "Year", select the applicable year.

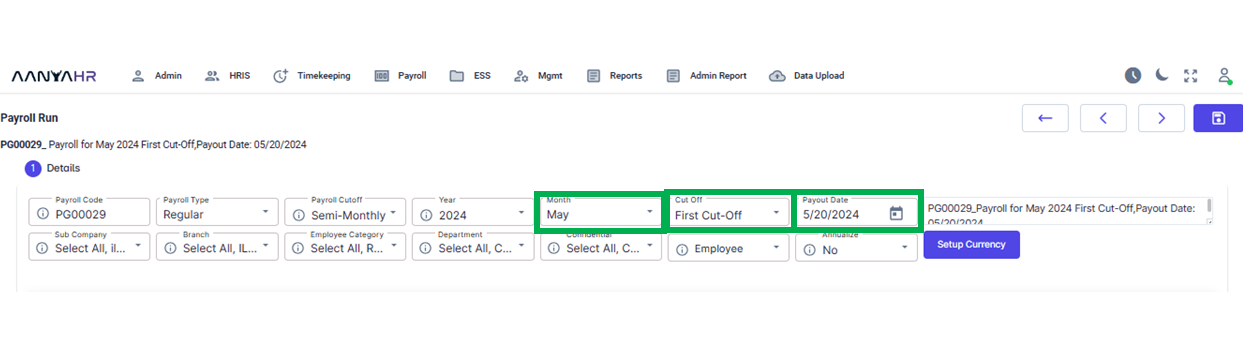

D. Once you have selected the applicable Year, the Month, Cutoff, and Payout Date will automatically fill in. It will reflect the recent details, you can modify the applicable details.

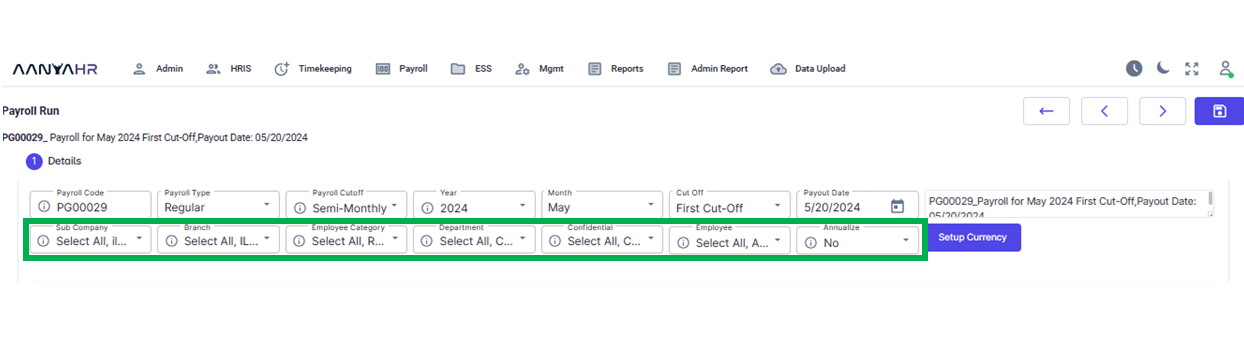

E. For the Sub Category, Branch, Employee Category, Department, Confidential, and Employees options, you can choose either ‘ALL’ or specific details. Under Annualize, you may select NO.

F. Once all the details are completed, click the Save button to save the Regular Run Pay run details.

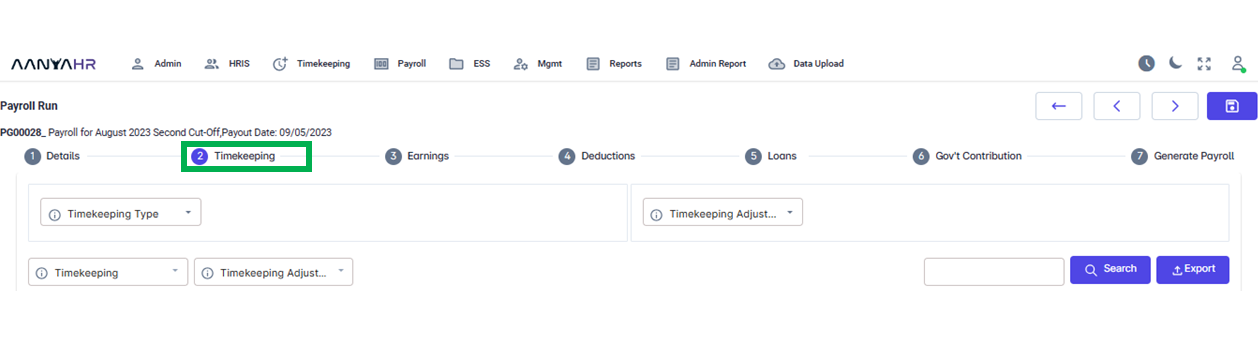

Step 2: How to use Timekeeping in Payroll Run? Let’s explore how to effectively manage different types of timekeeping (TK) uploads to ensure accurate payroll calculations in AanyaHR. In addition, you’ll discover how to create, upload, and remove different types of timekeeping records, along with the necessary procedures for handling any adjustments to timekeeping (TK).

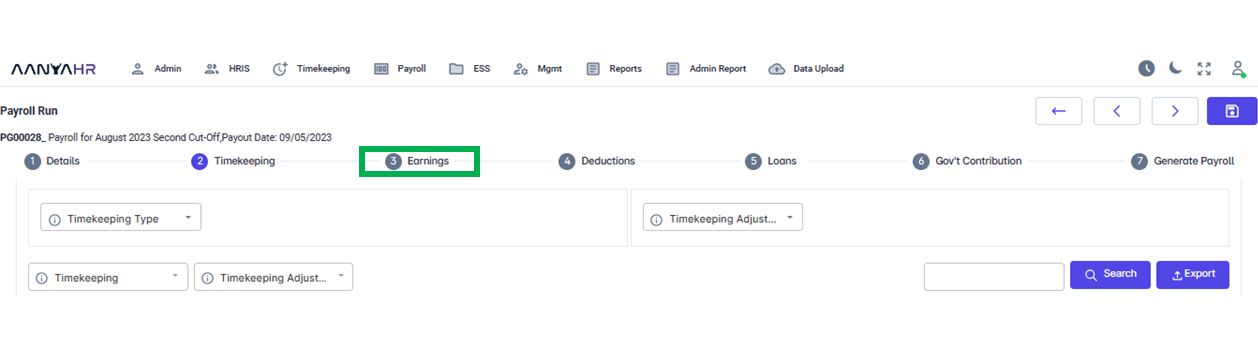

Step 3: How to use Earnings in Payroll Run? Discover how to upload earnings, as well as efficiently manage the deletion and updates of earnings to maintain accurate payroll calculations.

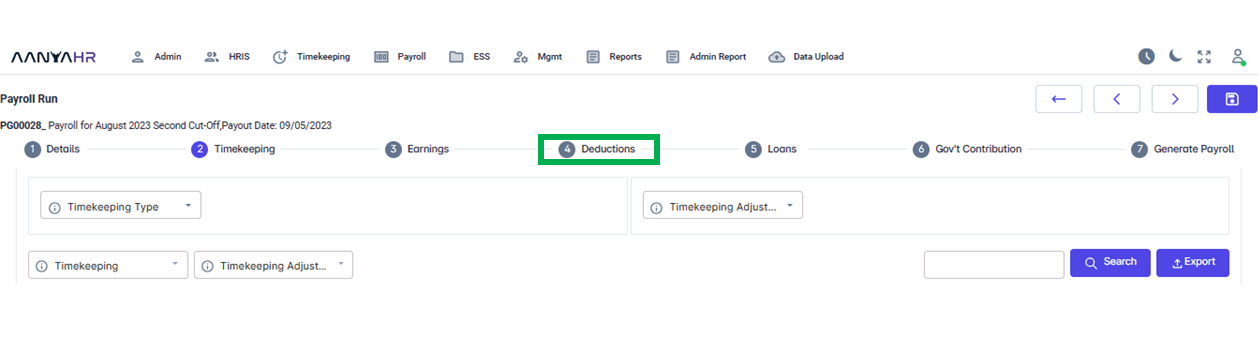

Step 4: How to use Deductions in Payroll Run? Learn the process of uploading deductions and master the efficient handling of their deletion and updates to ensure precise payroll computations.

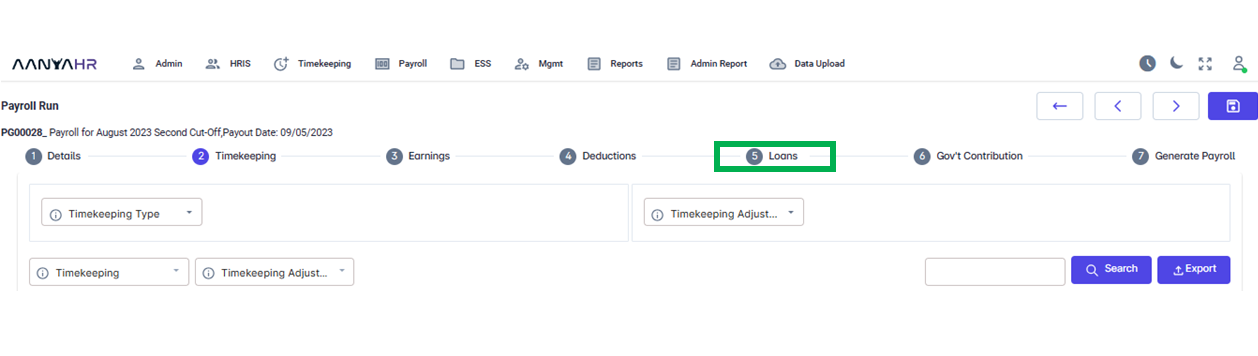

Step 5: How to use Loans in Payroll Run? Acquire knowledge on how to upload loans and become adept at managing their deletion and modifications to maintain accurate payroll calculations.

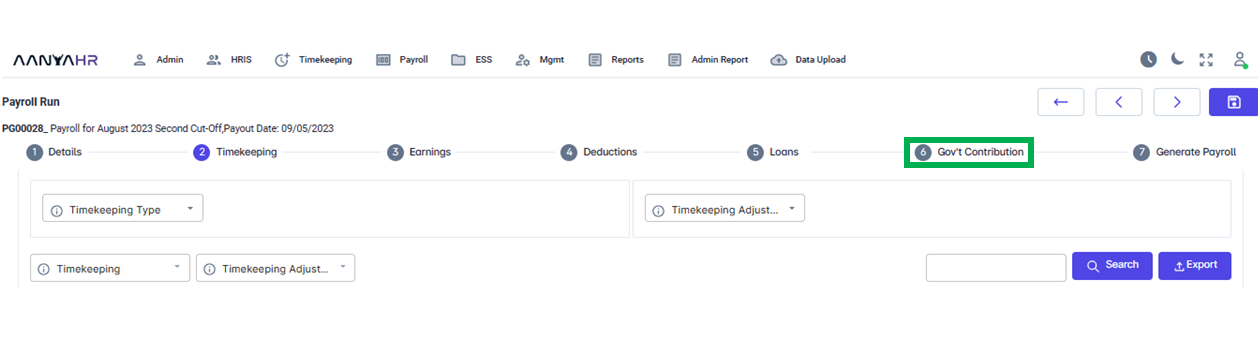

Step 6: How to use Government Contributions in Payroll Run?

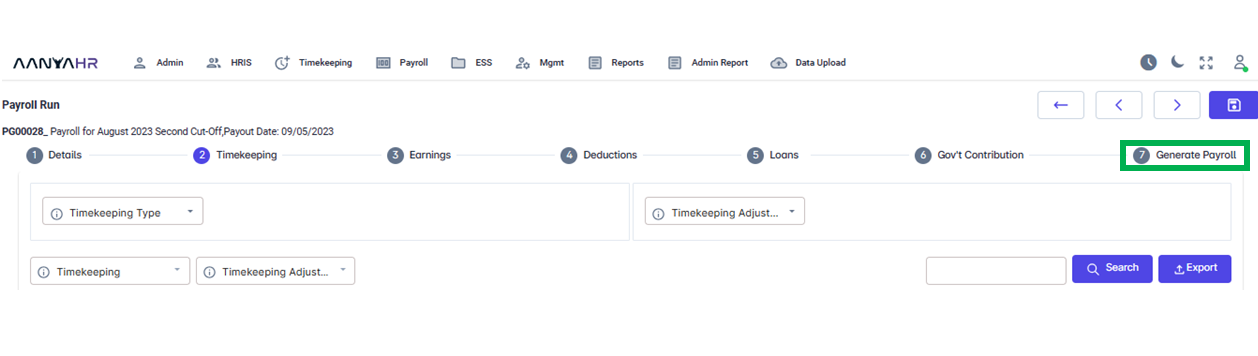

Step 7: How to use Generate Payroll in Payroll Run?

To access information about additional runs, consult the articles provided below.