Annual Reports are crucial documents that businesses in the Philippines must prepare at the end of each fiscal year. These reports are used to reconcile payroll activities and ensure compliance with the country’s tax and labor laws. These reports help businesses to identify any discrepancies, rectify errors in payroll records, and facilitate the accurate computation of taxes and benefits. It’s a comprehensive process that ensures businesses stay compliant and avoid legal repercussions.

Here are the Annual Reports that can be automatically generated in AanyaHR. For instructions on generating, please follow the steps outlined below.

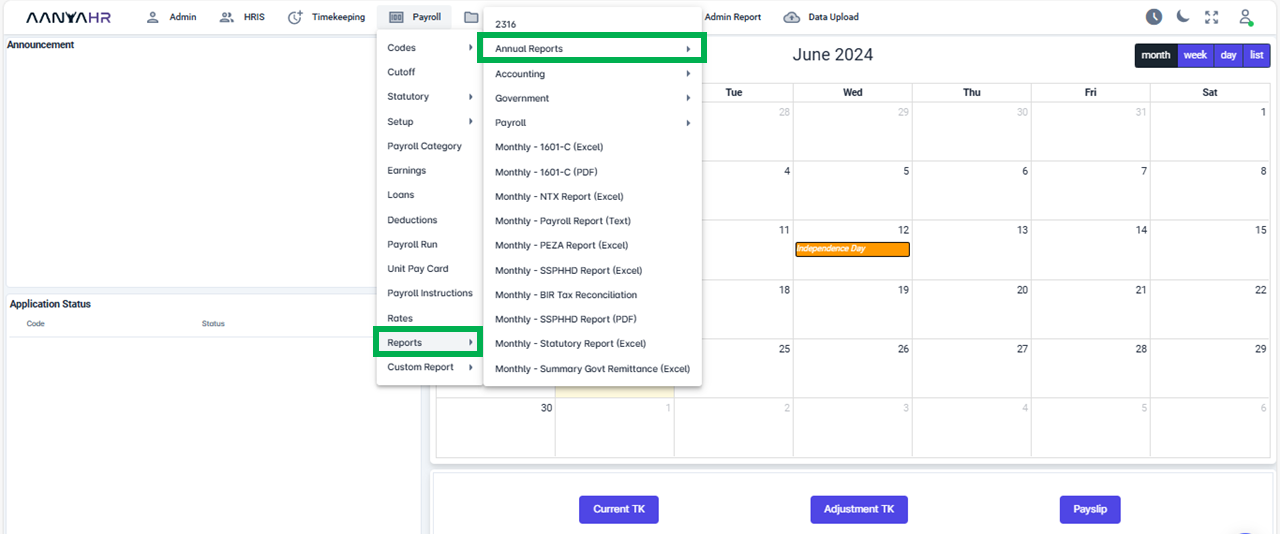

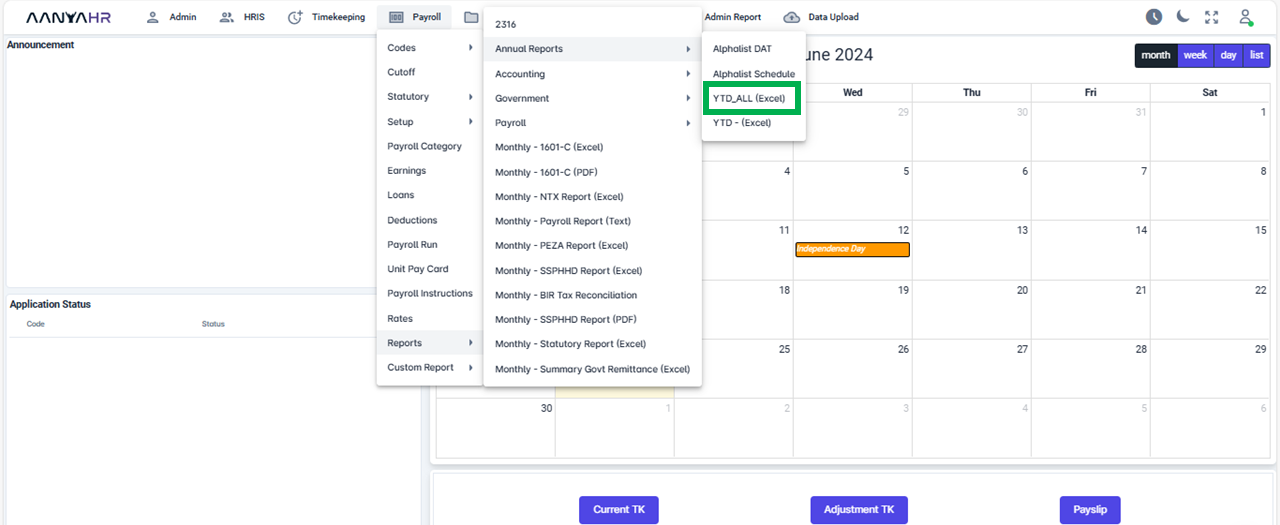

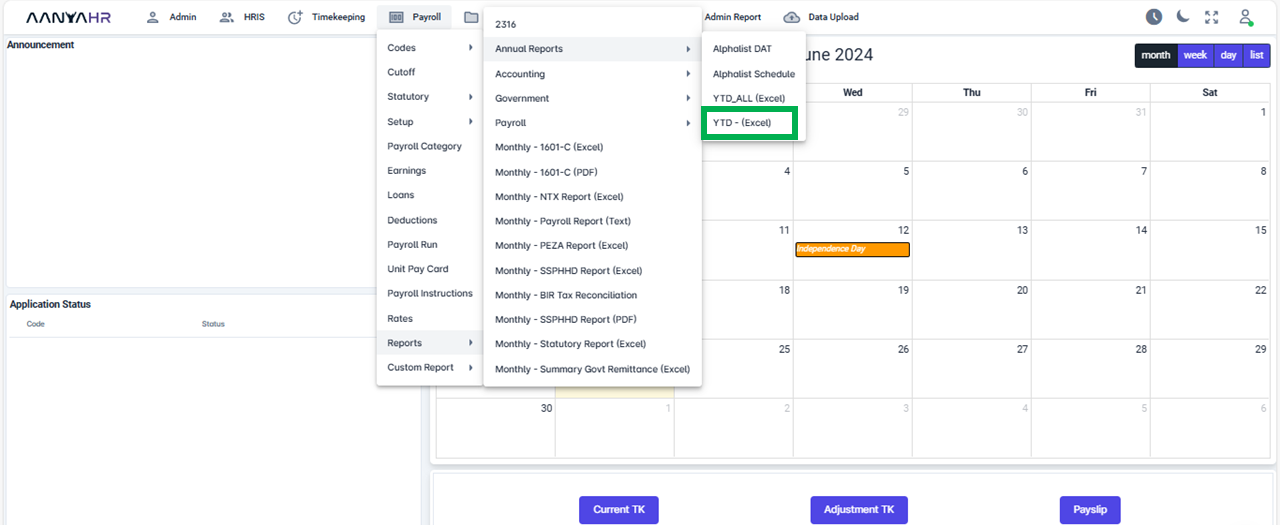

Go to Payroll and select Reports.

After selecting Reports, proceed to section Annual Reports.

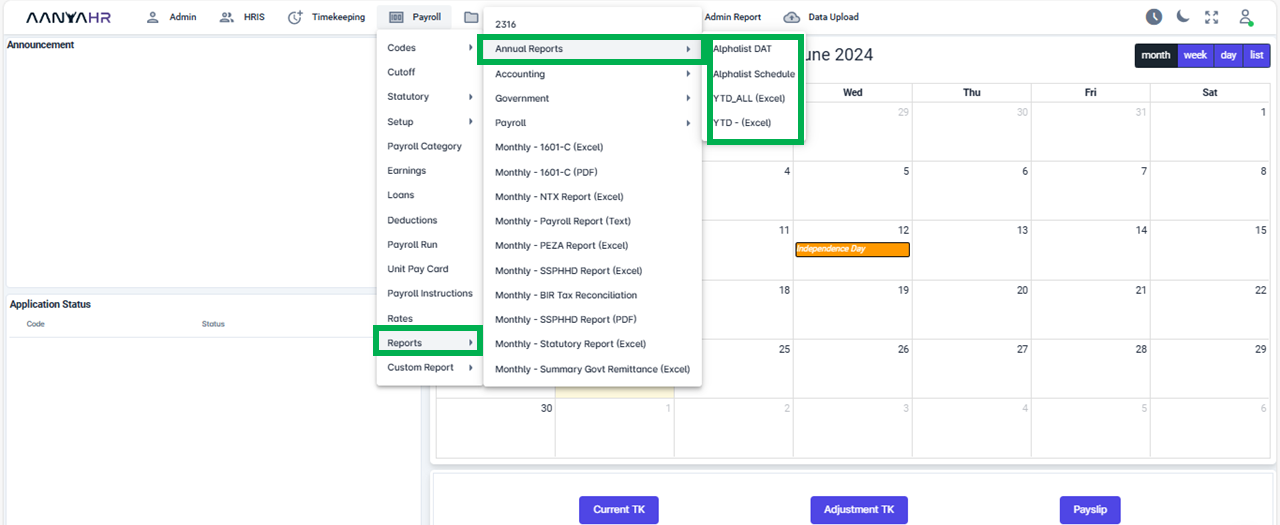

After choosing the Annual Reports option, you will be presented with all the relevant Specific Reports.

You can consult the subsequent Annual Reports for guidance on their generation.

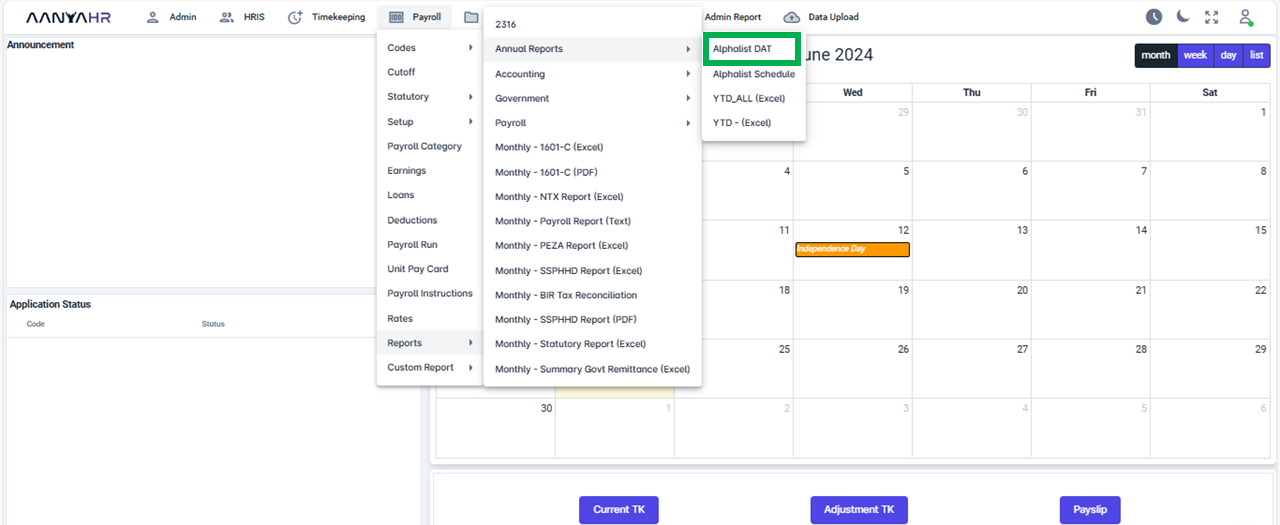

How to Generate Alpha list DAT? - The Alpha list DAT file is a data file required by the BIR. It’s used for submitting the Annual Alpha list of Payees that details the income payments and taxes withheld by a withholding agent/payor. This file is part of the requirements for the BIR Form 1604E, which is the Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax.

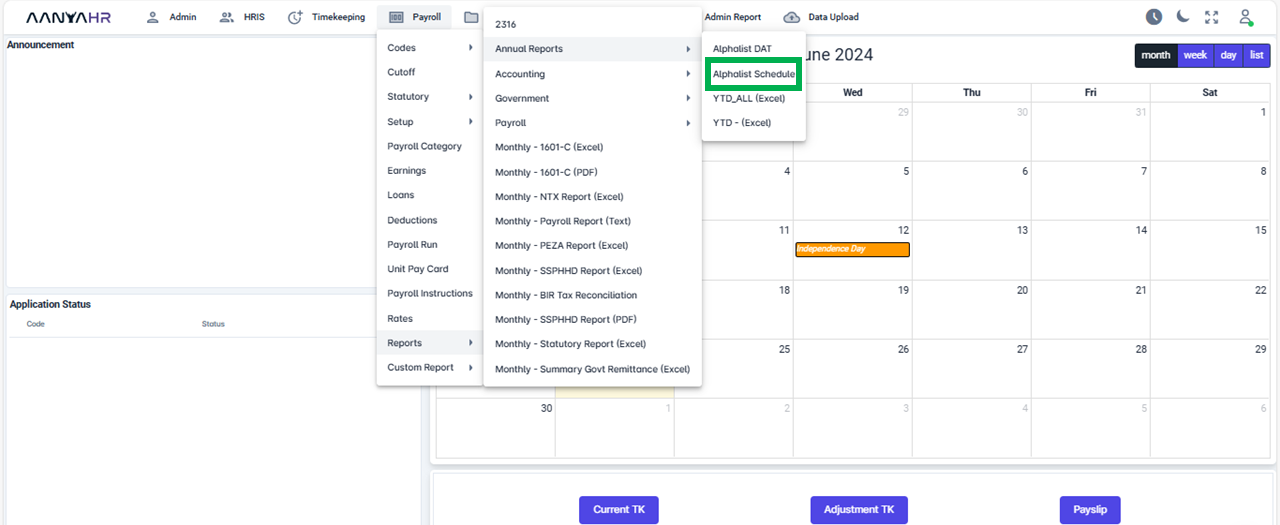

How to Generate Alpha List Schedule? - refers to the schedules, which is the Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax. These schedules are part of the Alpha list Data Entry and Validation Module that the BIR requires for tax compliance. These lists contain detailed information about the payees, such as their names, TINs, gross compensation, income tax withheld, and computations for either tax refunds or tax payable at the end of the calendar year. Employers must prepare and submit these schedules to the BIR to document and report the taxes withheld from their employees and other payees throughout the year. The Alpha list must be submitted on or before March 1 of the year following the calendar year in which the income payments subject to expanded withholding taxes or exempt from withholding tax were paid or accrued.

How to Generate YTD_ All (Excel)? - Year to Date of ALL Employees' payroll history for the current year in Excel File.

How to Generate YTD - (Excel)? - Year to Date of specific Employees' payroll history for the current year in Excel File.

Go back to: