Government Contributions also affect your salary by reducing your overall gross earnings, leading to a decreased net income or take-home pay.

Acquire the knowledge to upload Government Contributions, develop the expertise to manage their deletion and modifications, and guarantee accurate payroll calculations in AanyaHR.

The following are the functionalities and procedures related to Government Contributions within any payroll period in AanyaHR.

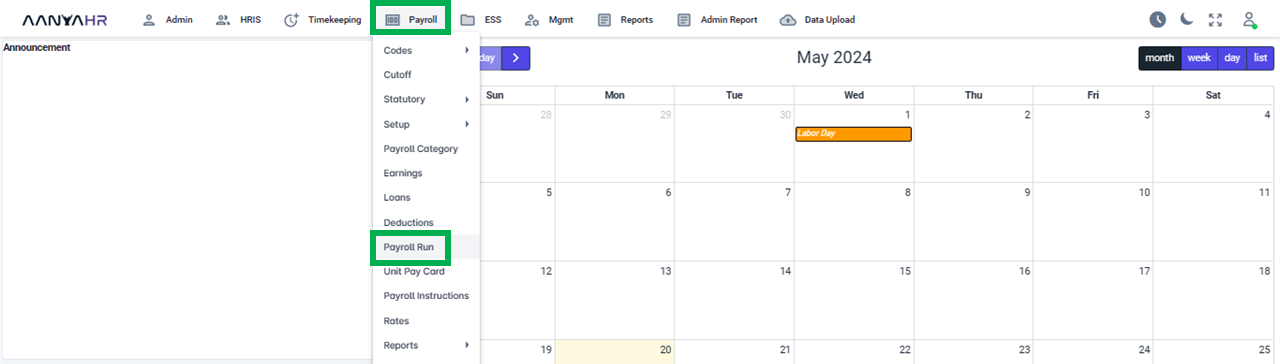

Click Payroll and select Payroll Run.

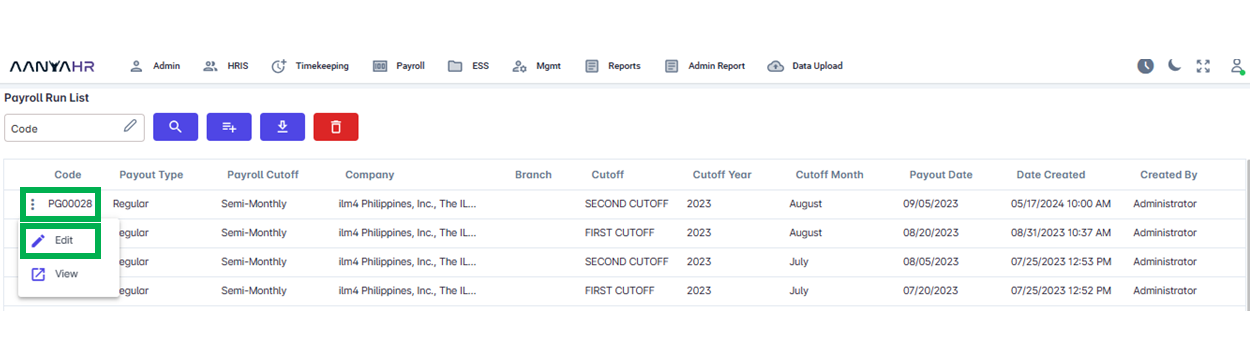

Once the specific Payroll Run is selected, click the ellipsis icon (3 vertical dots) and select Edit.

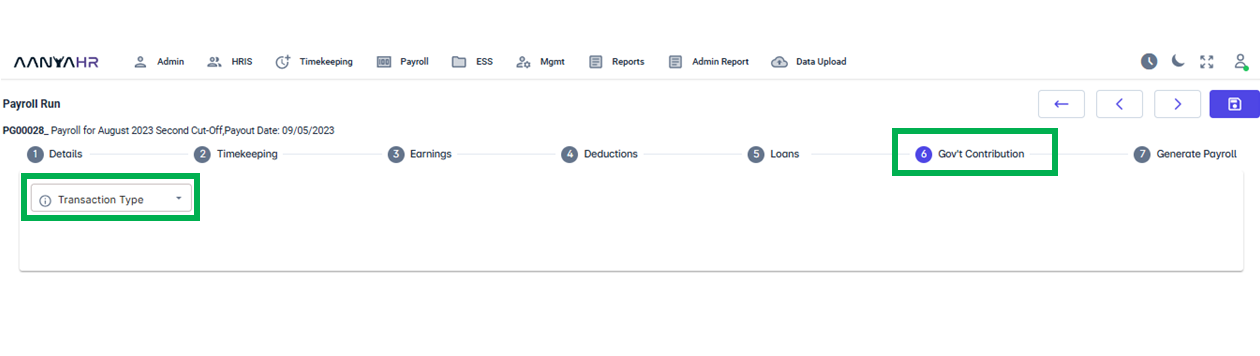

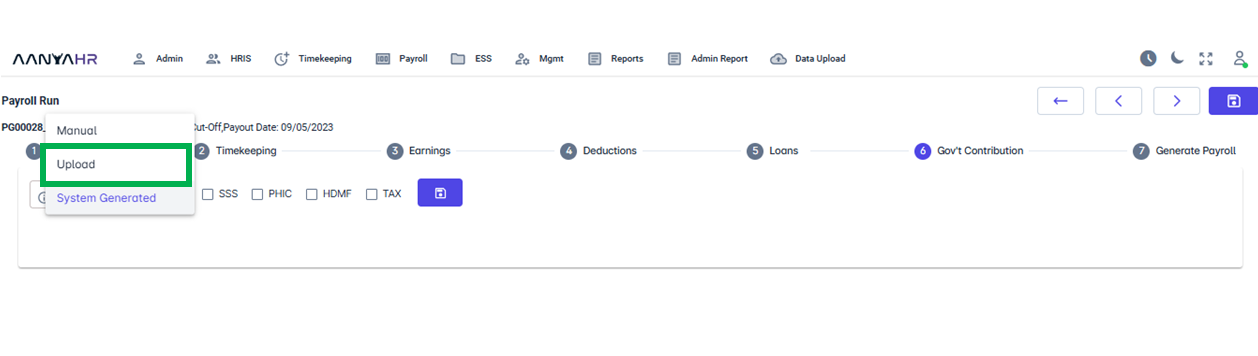

Navigate to the Gov't Contribution Module and choose a specific option from the dropdown menu within the Transaction section.

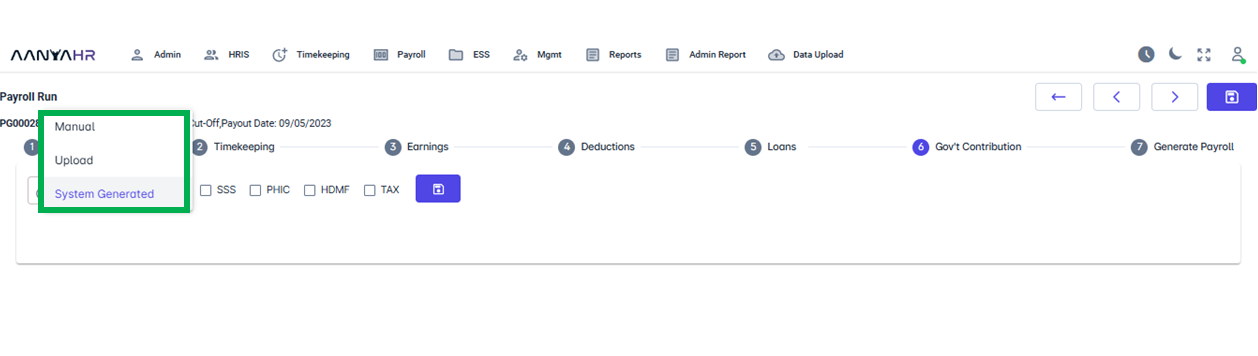

In the Transaction dropdown, you have the choice between three options, Manual, Upload and System Generated

Manual - use this to manually edit the Government Contributions. This feature has not been fully implemented in the system yet.

Upload - If you choose to override the system’s initially calculated Government Contributions.

System Generated - The system’s computation of Government Contributions is based on the initial configuration.

On how to use the Upload option in the Transaction dropdown. Select Upload.

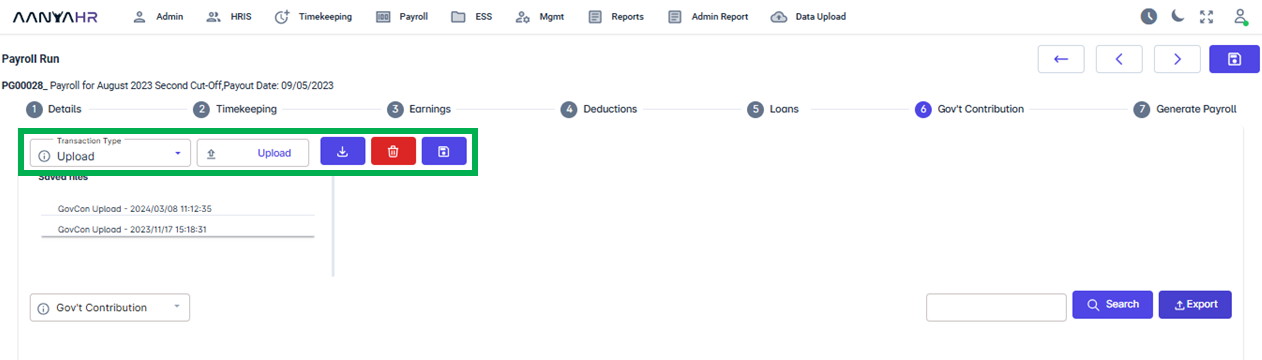

You may consult the definitions or purposes linked to tagging as depicted in the screenshot provided below.

Upload Button - A button for uploading a Government Contributions (GovCon) Template.

Download Icon -A button that provides access to Government Contribution Template.

Delete Icon - A button for deleting/removing the previously uploaded Template.

Save Icon - A button to press in order to save the Template that has been uploaded.

You may refer to the link procedure below on how to Upload the Government Contribution Template.

How to "Download" and Fill Out Government Contributions Template Upload in Payroll Run?

How to Delete/Remove GovCon Template Uploaded in Payroll Run?

Go back to: