Generating payroll reports is an essential task for businesses to manage employee wages, taxes withheld, statutory deductions, other deductions and loans. These reports can be generated for each payroll period, monthly, quarterly, or annually. They help streamline tax reporting, provide valuable budgeting information, ensure accurate tracking and offer actionable employee data.

These reports are the following also on how to generate it in AanyaHR.

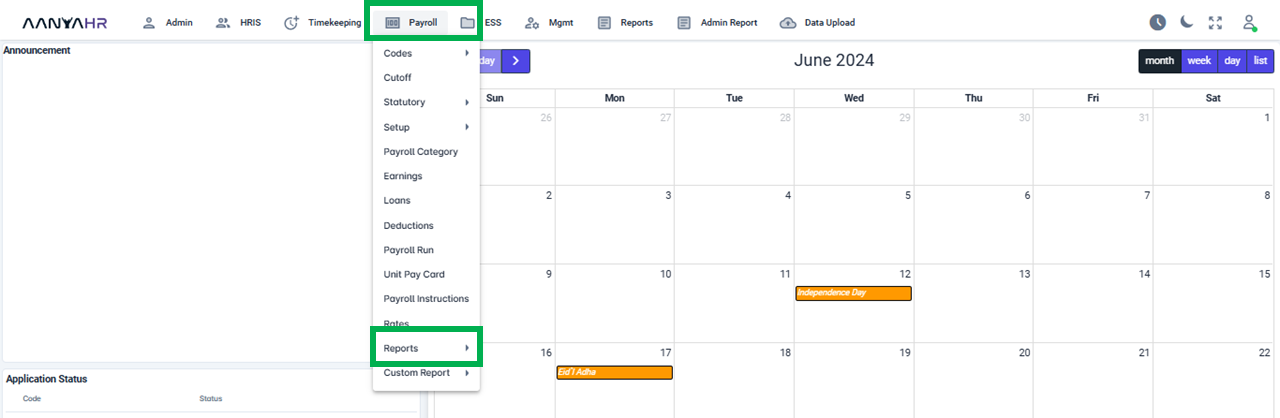

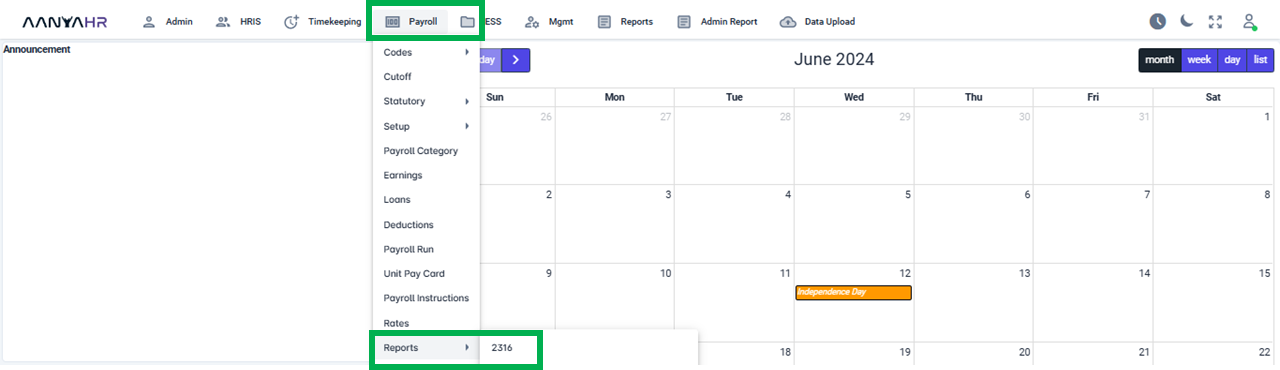

How to Generate BIR 2316 in Payroll Reports? - Let’s explore how to effectively manage the BIR 2316 generation in AanyaHR.

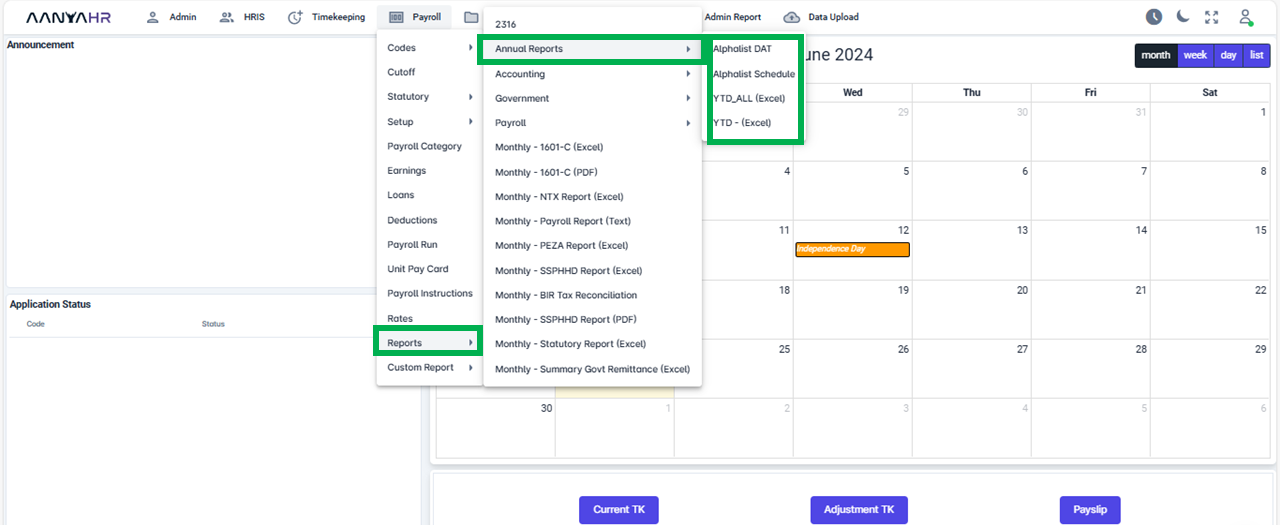

How to Generate Annual Reports? - We will delve into the efficient handling of generating the specific Annual Reports within AanyaHR.

Alpha list DAT - is a data file required by the BIR.

Alpha List Schedule - refers to the schedules, which is the Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax.

YTD_ All (Excel) - Year to Date of ALL Employees' payroll history for the current year in Excel File

YTD - (Excel) -YTD - Year to Date of Specific Employees' payroll history for the current year in Excel File. This document is designed exclusively for certain employee(s).

How to Generate Accounting Reports? - Let’s investigate the optimal approach to streamline the creation of Accounting Reports in AanyaHR.

JE - Standard (Excel) - This is referred to as Journal Entry for payroll.

JE - Cost Allocation (Excel) - Journal Entry for Cost Allocation.

JE - Custom 001 (Excel) - Journal Entry as custom report.

How to Generate Government Reports? - Let’s explore the best method to simplify and enhance the process of generating Government Reports in AanyaHR.

SSS (Social Security System) - is a government program designed to provide financial support to individuals during retirement, disability, or other life events that impact their ability to earn income.

SSS - Loan Remittance (Excel) - Loan remittances Excel File Format

SSS - Contribution Remittance (Excel) - Contribution remittances Excel File Format

SSS - Loan Remittance Report (Excel) - Loan remittances Excel File Format

SSS - Loan List (PDF) - Loan List PDF File Format

SSS - RA-1(PDF) - refers to the Republic Act No. 11199, also known as the Social Security Act of 2018. This act was established to rationalize and expand the powers and duties of the Social Security Commission.

PHIC

PHIC - Contribution Remittance (Excel)

PHIC - EPRS (Excel)

PHIC - ER2 (Excel)

HDMF

HDMF - Contribution Remittance

HDMF - Loan Remittance (Excel)

HDMF - Payment (Excel)

HDMF - MCRF (PDF)

HDMF - STLRF (PDF)

Payroll

Payroll - Earnings Report (Excel)

Payroll - Deductions Report (Excel)

Payroll - Audit (Excel)

Payroll - Loan History (Excel)

Payroll - Loans Report (Excel)

Payroll - Register (Excel)

Monthly - 1601-C (Excel)

Monthly - 1601-C (PDF)

Monthly - NTX Reports (Excel)

Payroll Report (Text)

Monthly - PEZA Report (Excel)

Monthly - SSPHHD Report (PDF)

Monthly Statutory Report (Excel)

Monthly - Summary Govt Remittance (Excel)

Payroll Reports - complete details of all the processed payroll every payout.