BIR 2316 is a Certificate of Compensation Payment/Tax Withheld in the Philippines. It’s a document issued by an employer to an employee, which details the income earned and the taxes withheld during the fiscal year. This form is necessary for employees earning purely compensation income, such as salaries, wages, and other forms of remuneration. It serves as proof that an employee’s pay has been subjected to income tax and is used for filing the annual income tax return.

For instructions on generating this within AanyaHR, please follow the steps outlined below.

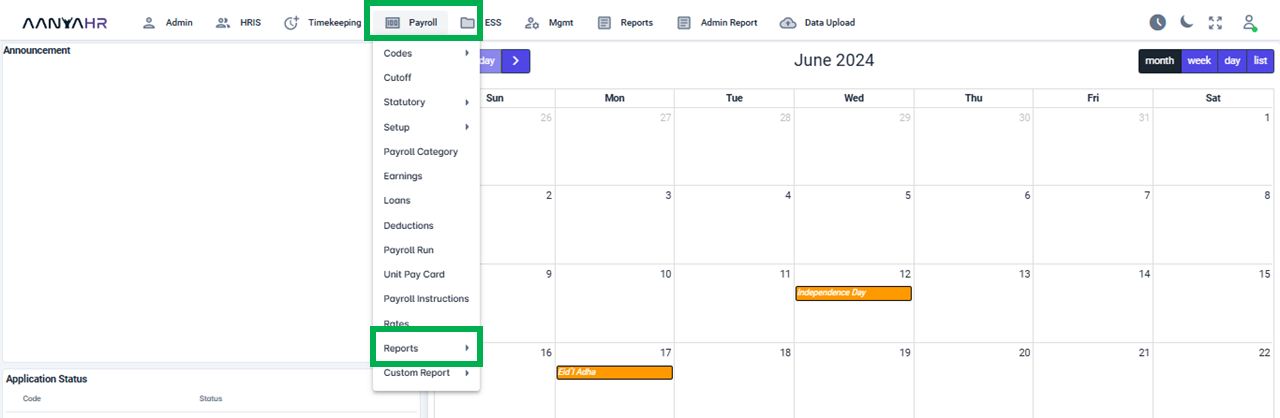

Go to Payroll and select Reports.

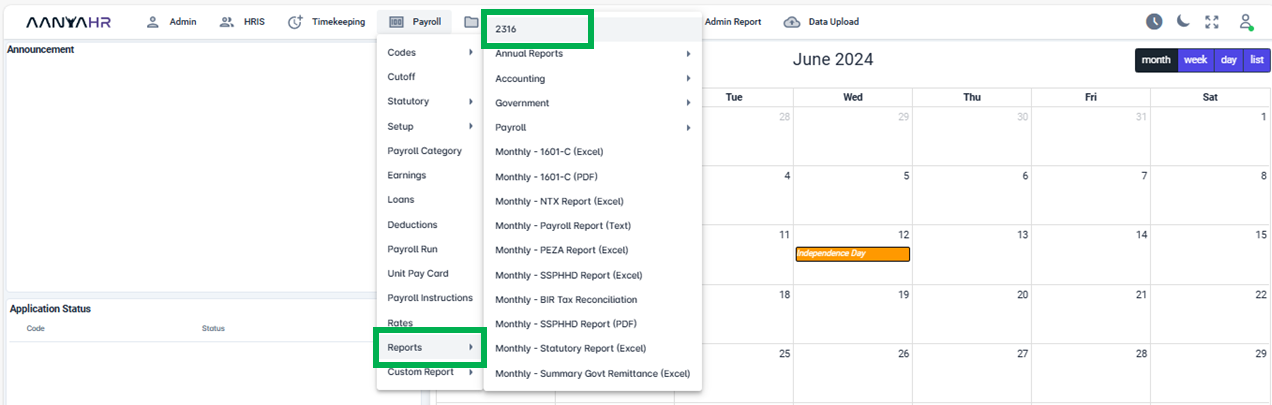

After selecting Reports, proceed to section 2316.

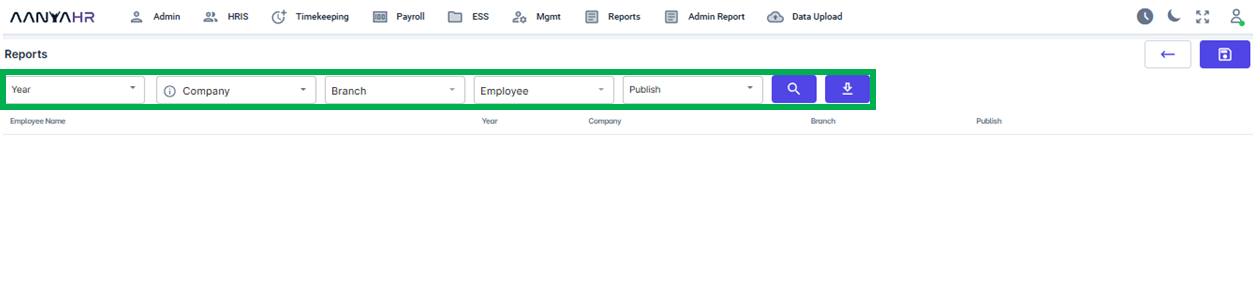

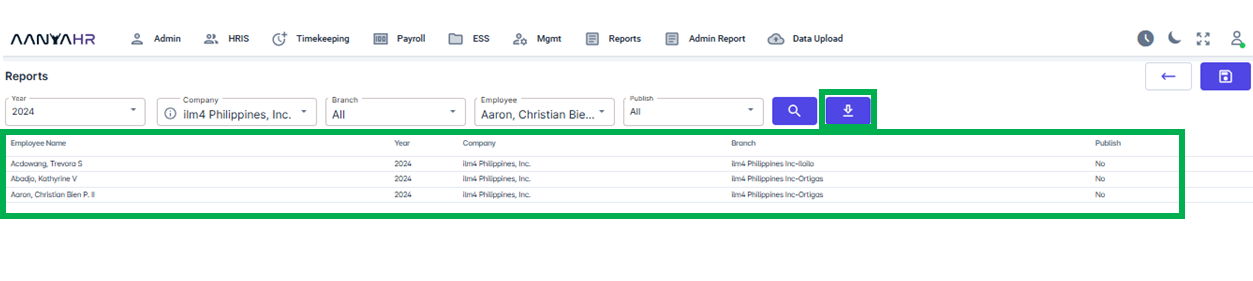

You can start entering the required information for the BIR 2316 form that needs to be generated.

For guidance to complete the details mentioned above, you can refer to the meaning or functions associated with tagging.

Year - you have to choose the specific year for the 2316 form generation from the dropdown menu.

Company - you have to choose the specific company from the dropdown list.

Branch - you have to choose the specific branch or have an option to select ALL branches. from the dropdown list.

Employee - you can choose individual employee(s) or opt to select All employees from the available options.

Status - it's either Publish, Unpublish or All.

Search Button - click on the icon to begin searching for the specified details.

Export Icon - to download the searched 2316.

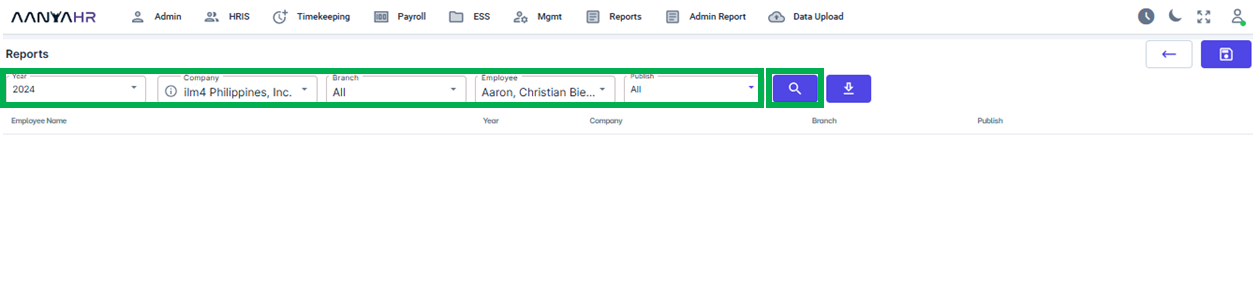

Once you completed the details click on the Search Button.

The information for the chosen details will appear in the lower section. To produce the 2316, click the Export icon.

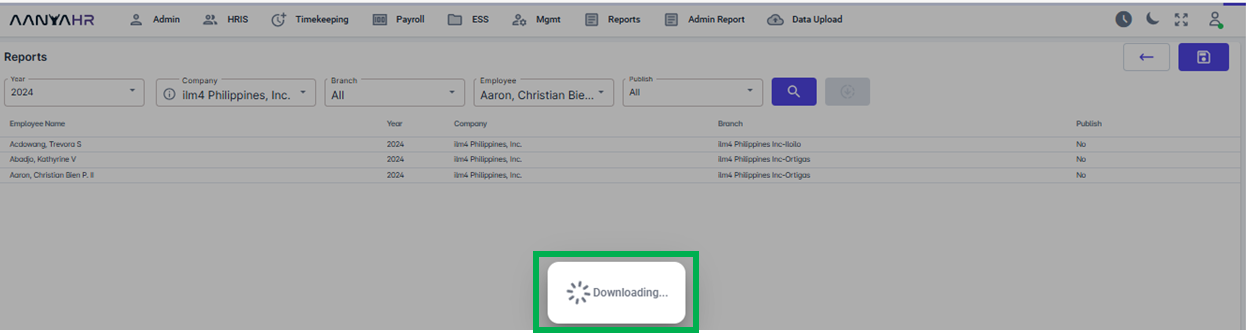

The download of the BIR2316 will commence through AanyaHR.

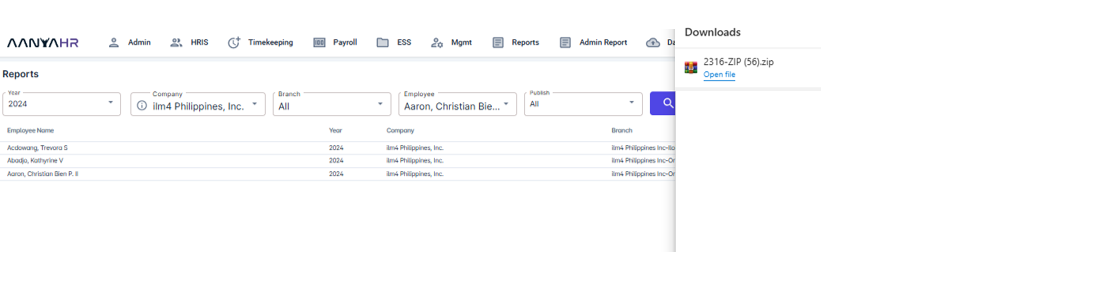

A downloadable zip file containing the BIR 2316 will be provided. Upon downloading, you can access the file to review your BIR 2316.

Go back to: