Payroll annualization is the process of calculating an employee's annual income, including their regular salary and any additional earnings or deductions, to determine their annual taxable income. In the Philippines, this practice is crucial for both employees and employers, as it affects income tax calculations, benefits, and compliance with tax regulations.

Please find below the AanyaHR features and procedures for the Payroll Annualization process.

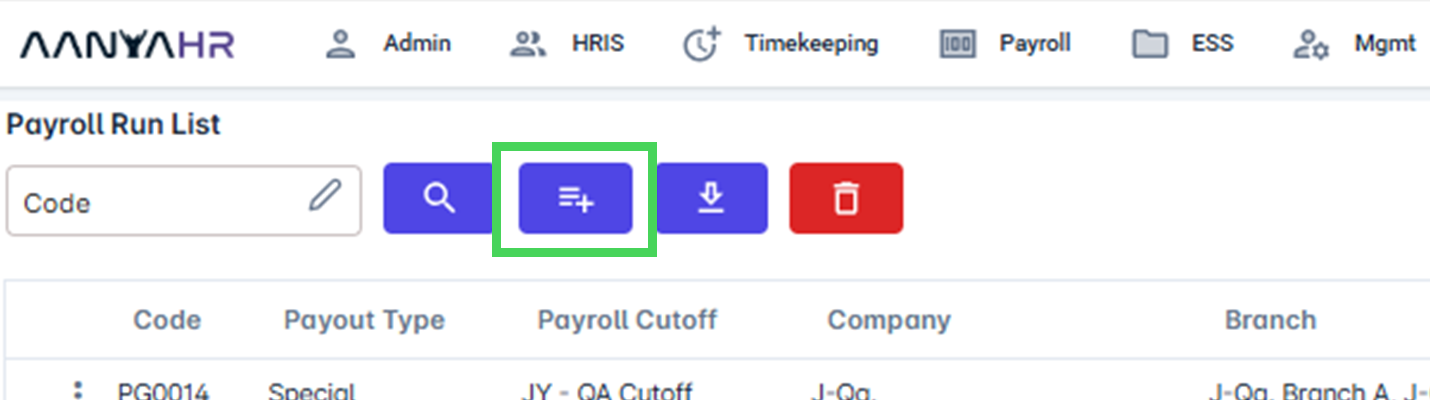

Click Payroll and select Payroll Run

Select Create or the plus (+) button to initiate a payroll run for Annualization

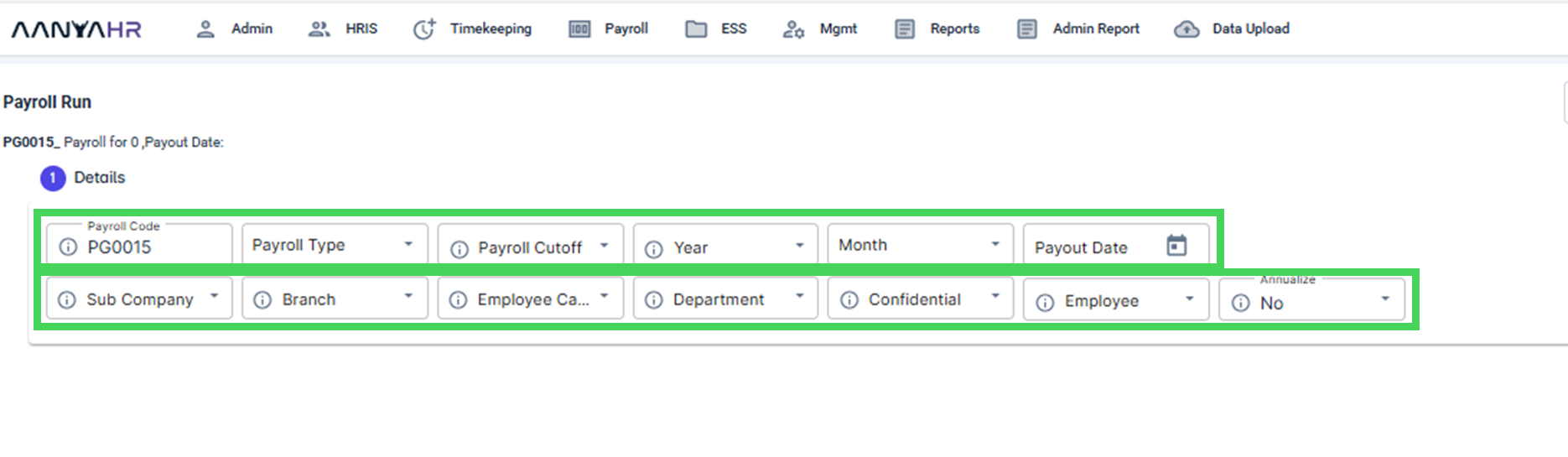

Complete the required fields.

For guidance to the highlighted details mentioned above, you can refer to the meaning or functions associated with tagging.

Payroll Code - is a unique identifier used to track and manage specific payroll runs in AanyaHR.

Payroll Type - this maybe Regular, Special, SSS Mat, 13th Month, Final processing in AanyaHR.

Payroll Cut off - is the deadline by which all payroll information, such as employee work hours, wages, deductions, and paid time off, must be submitted for processing.

Year - a specific year to process/annualize.

Month - a specific month to process/annualize.

Pay out Date - Specific payroll pay out date

Sub Company - Select specific company to process.

Branch - Select specific branch to process.

Employee Category - Select specific employee category to process.

Department - Select specific department/s to process.

Confidential -Select specific confidential or non-Confidential or both to process.

Employees - Select specific employee/s to process.

Annualize - An option YES or NO

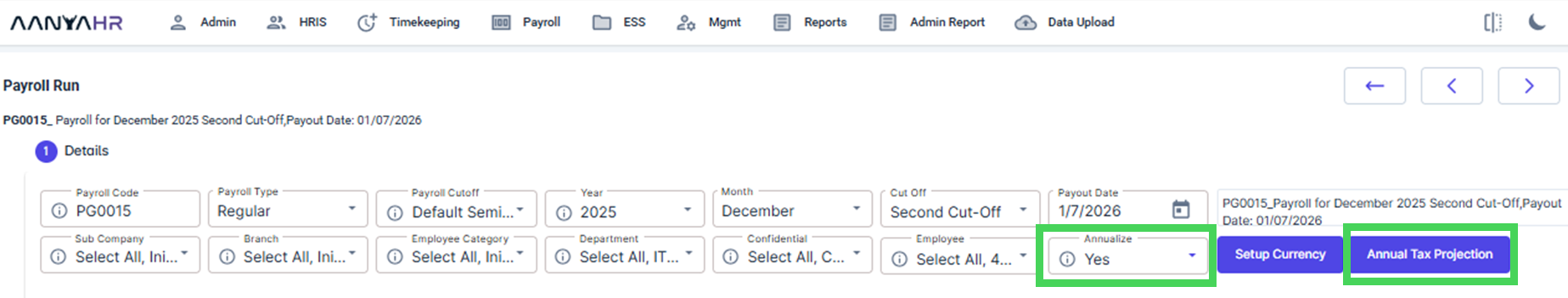

After completing the details above, click the YES button under ANNUALIZE to proceed. The Annual Tax Projection will then be displayed, click on it.

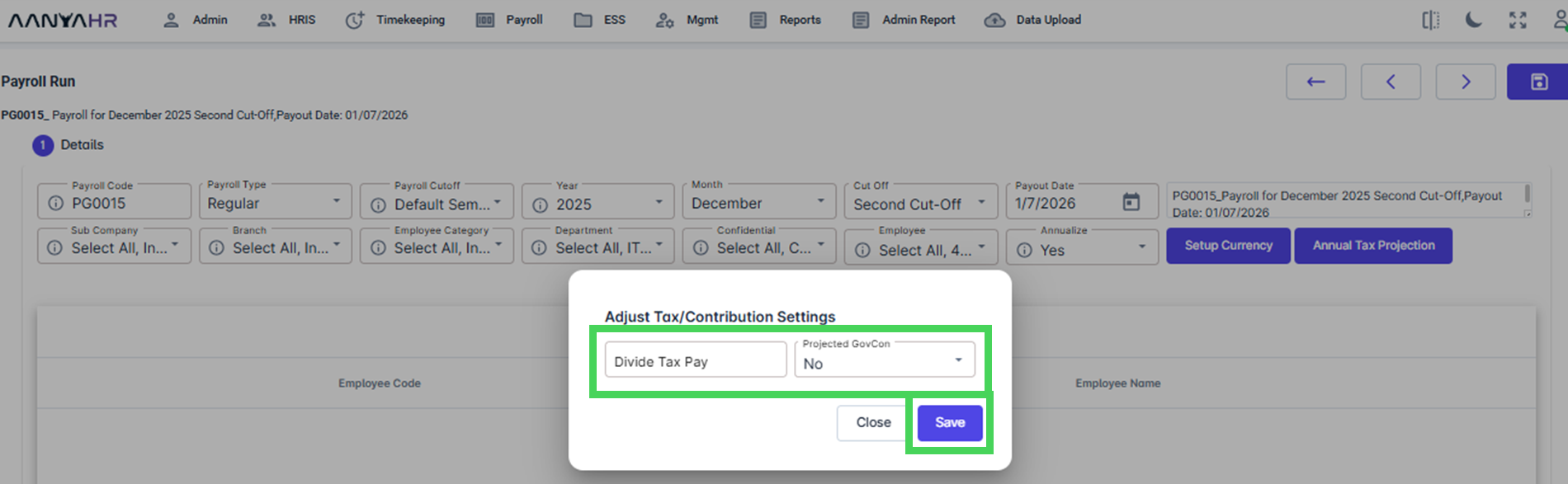

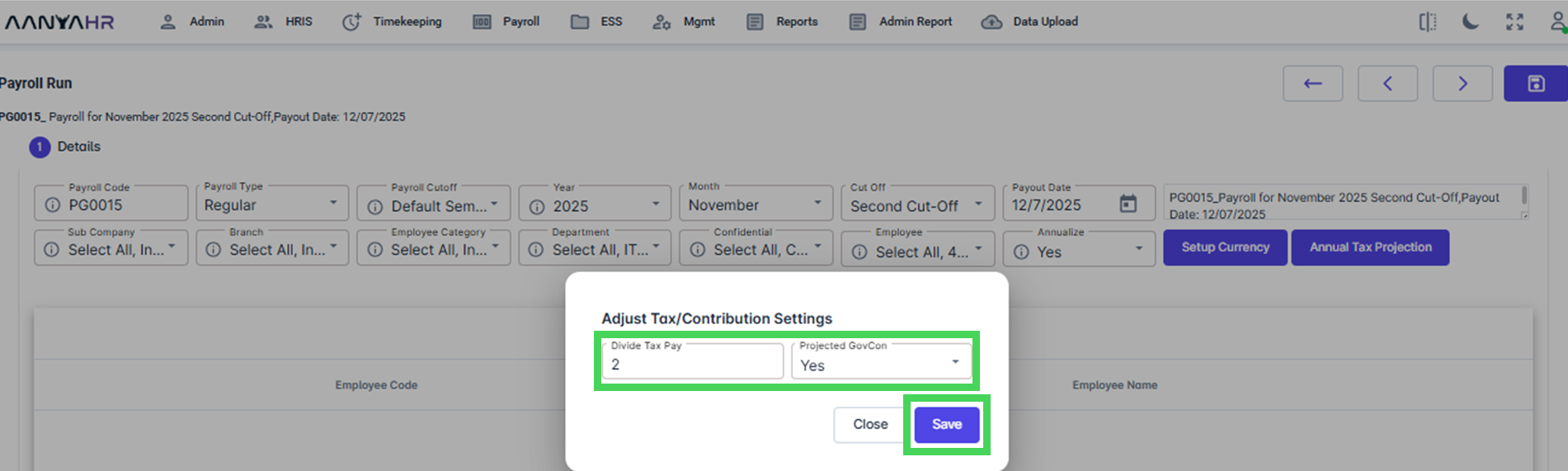

The Tax Adjustment/Contribution Settings will be displayed. Enter the number of cutoffs or pay periods to divide the tax payment under the Divide Tax Pay. Under Projected GovCon, choose YES from the dropdown if you want to project Government Contributions, or select NO if you do not, Click Save Button.

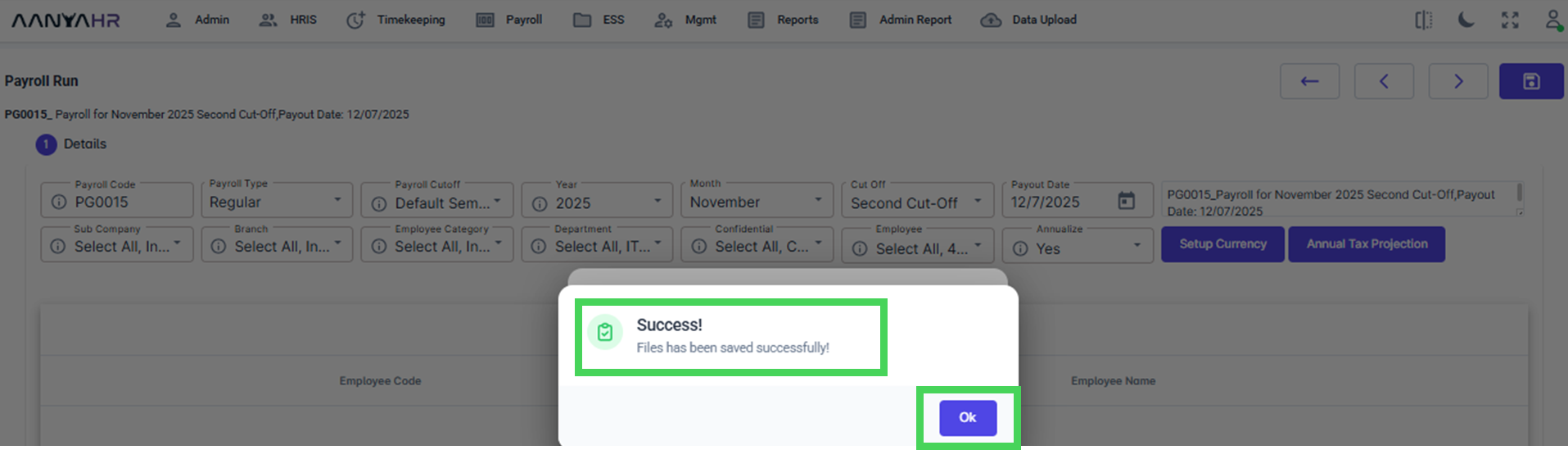

Once Saved, a notification will appear, stating that the file has been successfully saved. Click Ok to proceed.

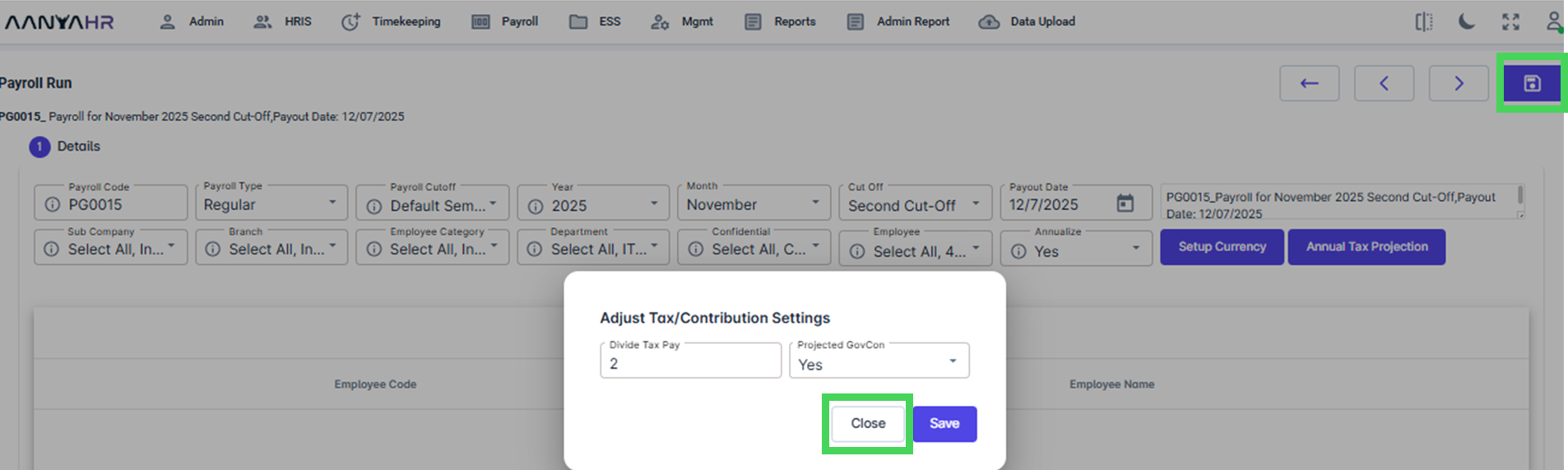

Click Close to close and click the Save button to save the Annualized payroll run set up and proceed with the regular payroll run processing with the Annualized tax Calculation.

Go back to :