For the instructions on downloading and fill out the Government Contributions Template Upload in the Payroll run, please refer to the following procedures.

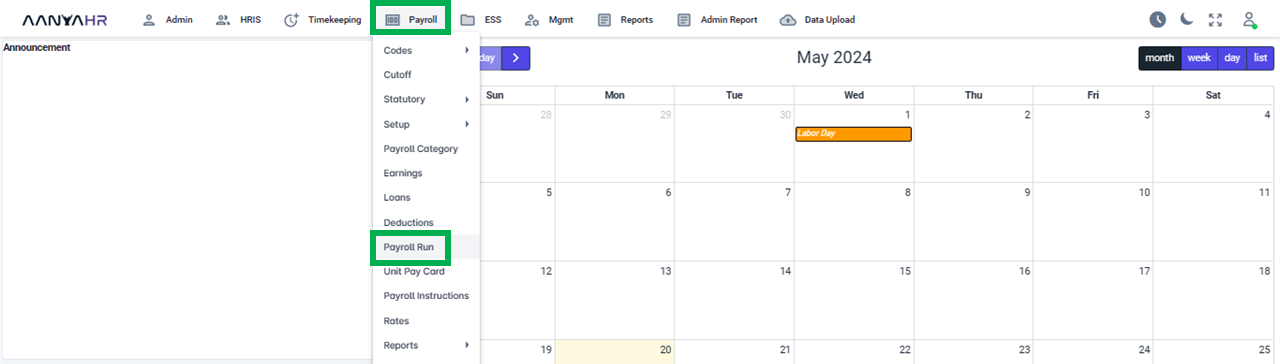

Click Payroll and select Payroll Run

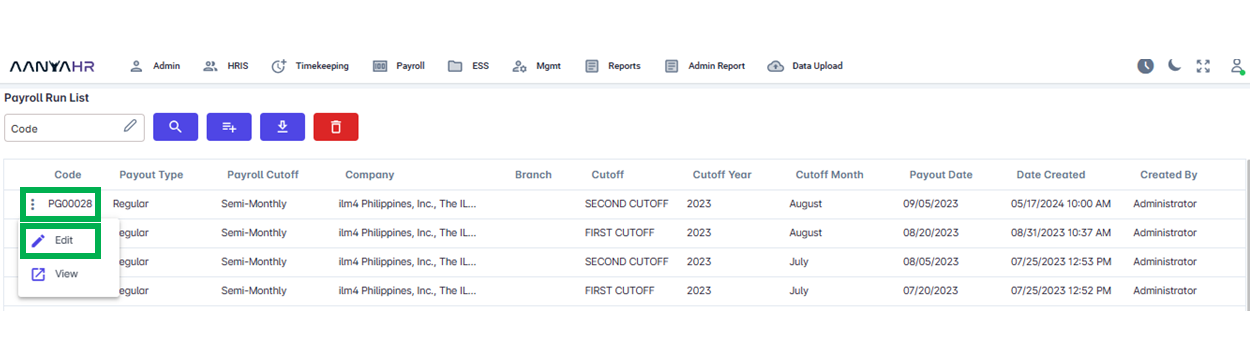

Once the specific Payroll Run is selected, click the ellipsis icon (3 vertical dots) and select Edit

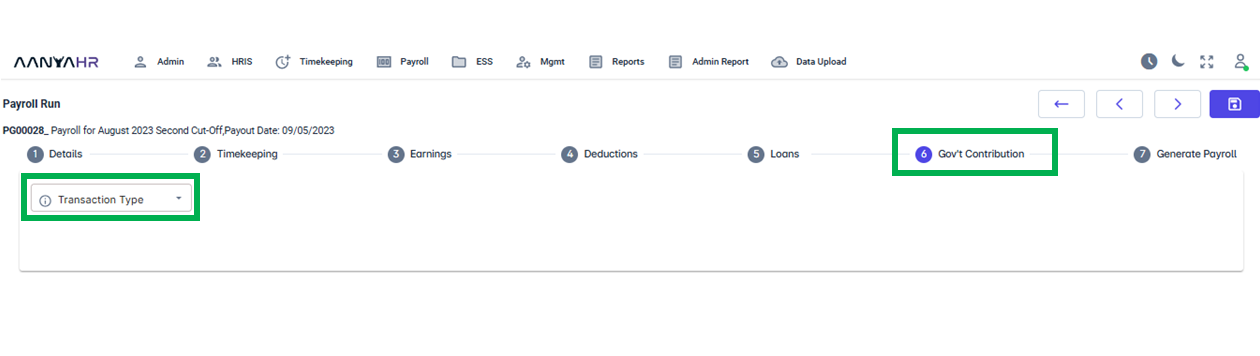

Navigate to the Gov't Contributions module and choose a specific option from the dropdown menu within the Transaction section.

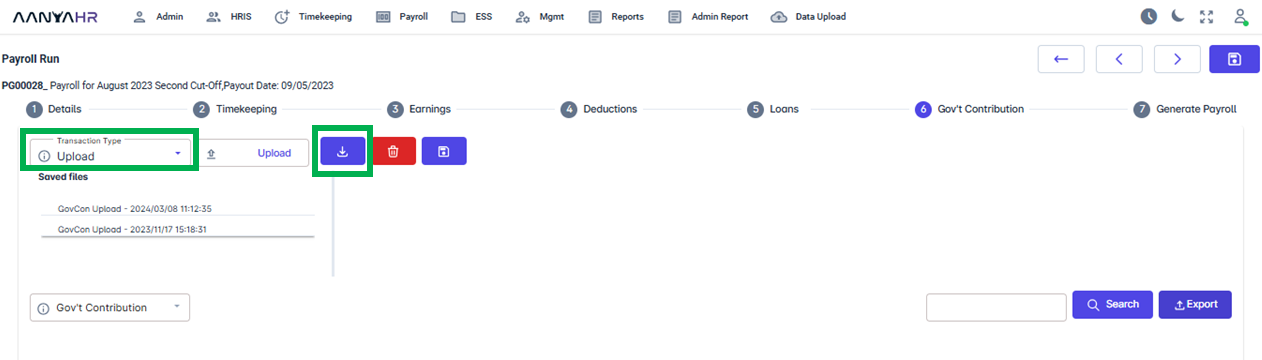

To Download the Government Contributions Template, select Upload in the Transaction Type and click on the Download icon.

Upon selecting the Download icon, a template will be created, " New Govcon Upload" Template.

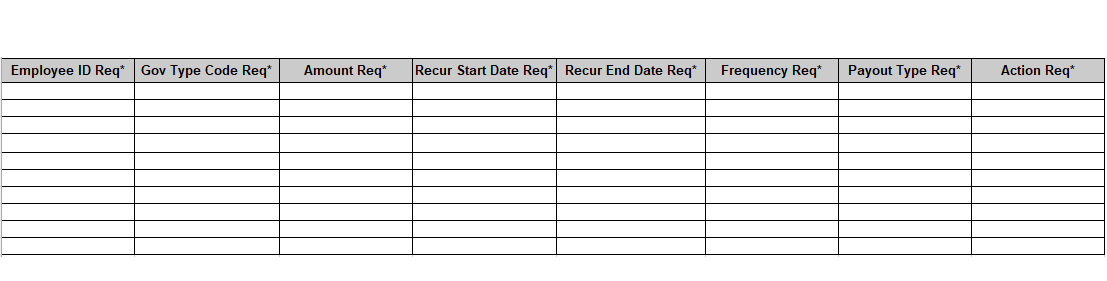

Complete the downloaded template. For guidance on how to do so, please see the details below.

Employee ID Req* - where you will input the Employee ID of the employee.

Gov Type Code Req* - Code use for the specific Government Contributions. It's either the following:

SSSEE - refers to the Employee SSS Contribution.

MPFEE - refers to the Employee SSS Mandatory Provident Fund Contribution.

SSSER - refers to the Employer SSS Contribution.

MPFER - refers to the Employer SSS Mandatory Provident Fund Contribution.

SSSEC - refers to the Employees’ Compensation (EC) Program of the SSS.

PHICEE - refers to the Employee PhilHealth Contribution.

PHICER - refers to the Employer PhilHealth Contribution.

HDMFEE - refers to the Employee Home Development Mutual Fund Contribution or Pag Ibig Fund.

HDMFER - refers to the Employer Home Development Mutual Fund Contribution or Pag Ibig Fund.

TAX - refers to the withholding tax deductions.

Amount Req* - Specific amount of the contributions.

Recur Start Date Req* - refers to the Start or End Date of the Cut - off or Date within the cut - off.

Recur End Date Req* - refers to the Start or End Date of the cut off or Date within the cut - off.

Note:

For Final Pay, Special Pay, and SSS Maternity: Simply enter the payout date for both the Recur Start Date and the Recur End Date.

For Regular Pay: enter the payroll cutoff date for the Recur Start Date and the Recur End Date.

Frequency Req* - this can be either:

First - In the event that the deduction occurs on the First pay period.

Second - In the event that the deduction occurs on the Second pay period.

Both - In the event that the deduction occurs on Every pay period.

Note:

For Final Pay and Maternity Pay: Do not enter any frequency; simply leave it blank.

For Special Pay and Regular Pay: It is necessary to input the frequency.

Payout Type Req* - this can be either the processing of the following

Regular

Special

Final

13th Month Pay

SSS Maternity

Action Req* - Select any applicable actions: Replace, Add, or Deduct.

For Regular Payroll Run, refer to these details

GovCon Upload - Recur Start Date and End (Date between the cutoff Date)

For Special Run

GovCon Upload - Recur Start Date and End -Payout date

For Maternity Run

GovCon Upload - Recur Start Date and End - Same date of the payout date.

Frequency - BOTH

Pay out Type - SSS MAT

For Final Pay Run

GovCon Upload - Recur start and Recur end (Pay out date)

Payout Type - FINAL

Action - Replace

After finalizing the template, save the file and proceed with its upload.

Go back to: