In AanyaHR payroll details, you can configure Five different payroll types. Here are the specifics:

Regular - This refers to the standard and regularly processed for all employees. The regular payroll is the standard payment process for typical employees, covering their regular wages.

Special - This type caters to unique scenarios or specific employee groups, such as one-time bonuses, salary adjustments, or other exceptional compensation. Process special payroll separately from regular payroll runs.

SSS Mat - This process refers to the Social Security System (SSS) Maternity Benefit to eligible female members. The Maternity Benefit applies to every instance of pregnancy, miscarriage, or emergency termination of pregnancy, regardless of frequency.

Final - This refers to the sum of all wages or monetary benefits due to an employee upon termination or separation from employment. Final pay ensures you receive what you’re owed upon leaving the company.

13th Month - This is an additional compensation given to employees, typically at the end of each year. It’s a government-mandated benefit under Presidential Decree No. 851. Rank-and-file employees in the private sector, regardless of position or employment status, are entitled to this benefit as long as they’ve worked for at least one month during the calendar year. The computation is based on their total basic salary earned within the year, divided by 12 months. If you’ve worked for less than 12 months, your 13th-month pay will be prorated based on the months you’ve worked.

Let’s outline the steps for accurately setting up Payroll Detail in AanyaHR:

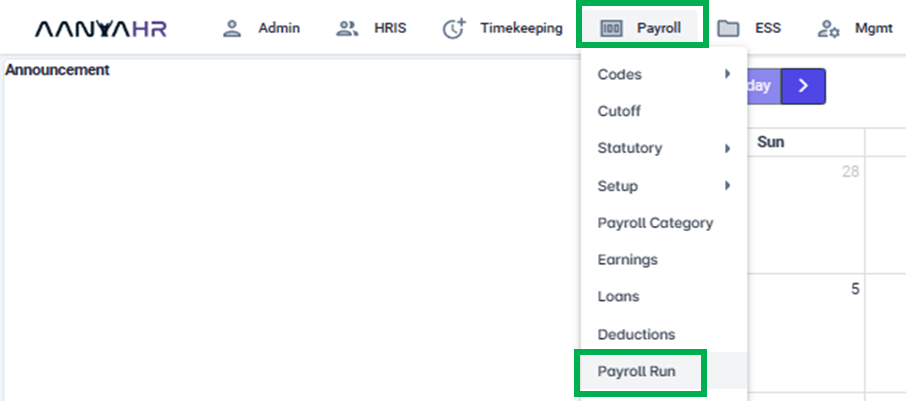

Go to Payroll > select Payroll Run

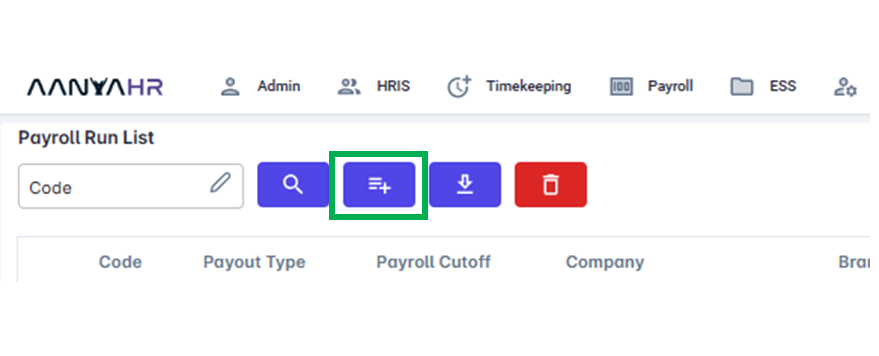

Click Create

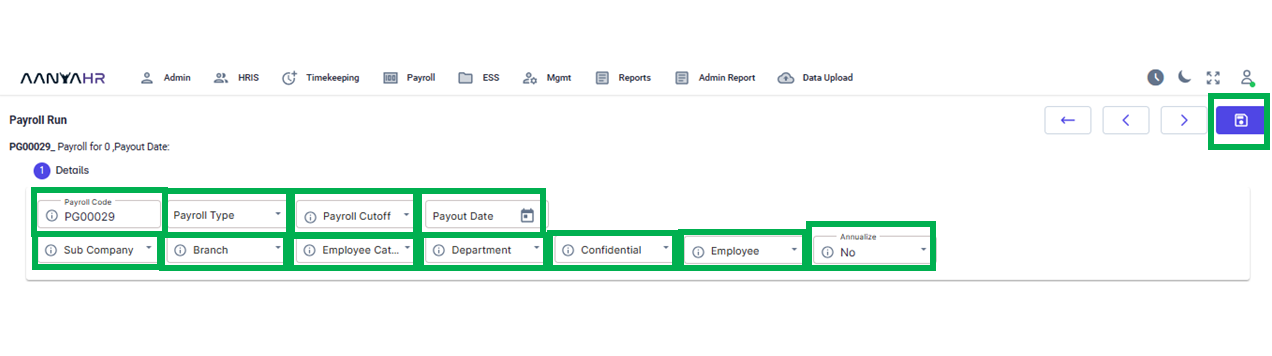

After clicking the Create button, a Pay run code will be generated automatically

After clicking the Create button, a Pay run code will be generated automatically

Select the specific Payroll type.

For guidance on setting up Payroll Detail, you can refer to the meaning or functions associated with tagging.

Payroll Type - you may refer to these types

Go back to :