Learn the steps to complete the Loans template for uploading to AanyaHR. The instructions are provided below for your guidance.

Go to AanyaHR and Login to your account.

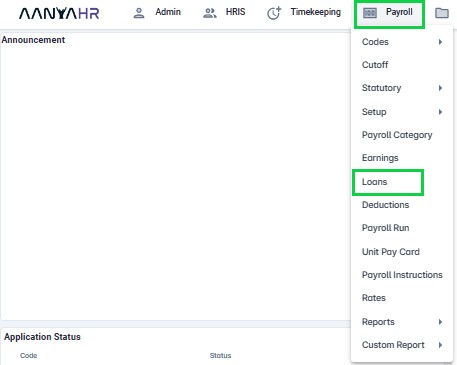

Go to Payroll > then select " Loans ".

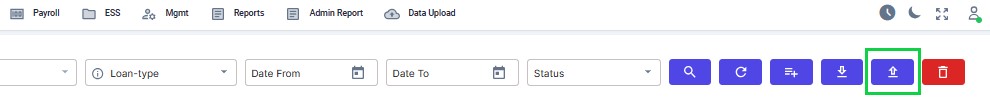

Click the “Upload” button.

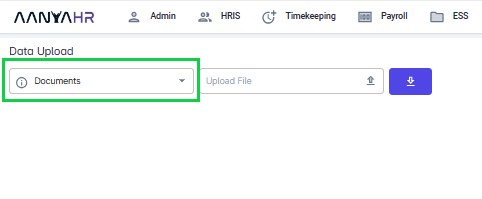

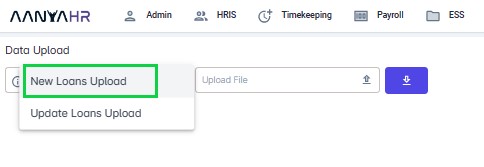

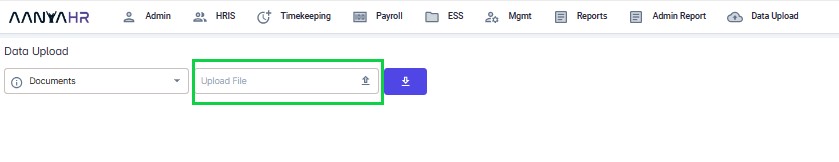

Select “New Loans Upload” from the Documents list.

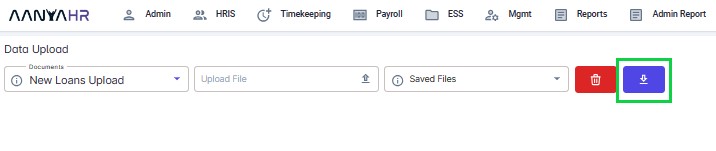

Click “Download Template” button.

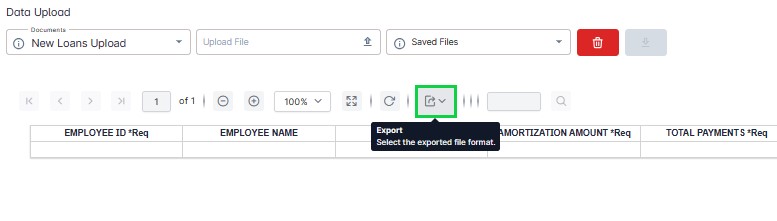

Click “Arrow down in a box” to select the exported file format.

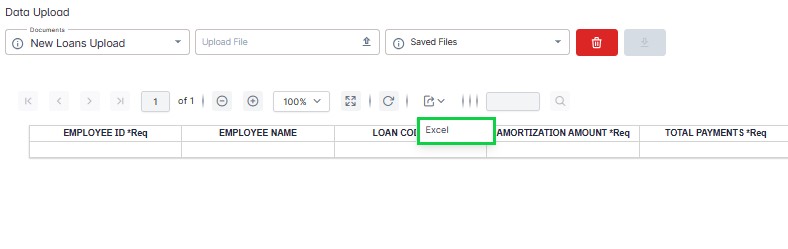

Click “Excel” to export the template.

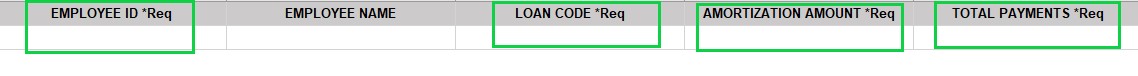

Fill out the required fields.

All with asterisk are the required fields.

*Employee ID – Input the Employee ID same with the ID in the master list from the system.

*Loan Code – Input the Loan code that is already set up in the system.

*Amortization Amount – Input the amortization amount to deduct for that employee.

*Total Payments – Input the total amount of the loan payments that have already been paid. Put zero "0" if no payment has been made.

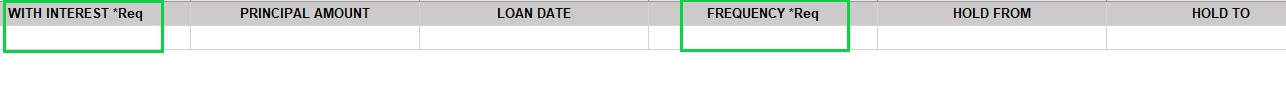

*With Interest – Input the total loan amount plus the interest amount that needs to be deducted. (Please note that if the loan has no interest amount simply input the total loan amount to be deducted).

*Frequency – You may choose to these frequencies:

1. 1st – the loan deductions will be deducted every 1st payout.

2. 2nd - the loan deductions will be deducted every 2nd payout.

3. Both – the loan deductions will be deducted to every payout.

4. For once-a-month Payout, use “1st”.

Note:

For Special Pay and Regular Pay: You need to specify the frequency.

For Final Pay and SSS Maternity: There is no need to input a frequency.

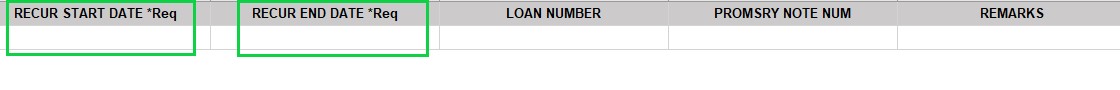

*Recur start – Input the start date of loan deductions in “mm/dd/yyyy” format.

*Recur end date - Input the end date of loan deductions in “mm/dd/yyyy” format.

Note:

For Regular Payroll: It is necessary to input the Recur Start Date and the Recur End Date.

For Final Pay, Special Pay, and SSS Maternity: Do not input the Recur Start Date and Recur End Date.

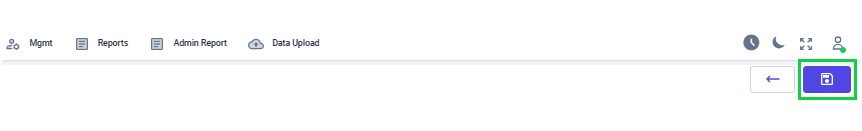

Click “Upload” to upload the file.

Click “Save” changes.

Go back to:

How to "Download" Loans Template Upload in Payroll Run and fill out?