Go to your AanyaHR and log-in your account

Go to Payroll > Reports > Annual Reports > Annualization

Fill up the necessary informations for annualization

Company: Select the company to extract the annualized report

Year: The coverage year

Divide Tax Payable By: Indicate the number of cut-off's for equal deduction of annualized tax.

13th month pay: The calculation basis of the 13th month pay.

Exclude Tax From: Select the preferred payroll cut-off to exclude in actual tax payable.

Project Govcon: Select "Yes" to project govcon for the remaining cut-off or months that are not yet processed. "No" if not preferred to project the Govcon.

Employee Status: Select the status of employees to extract, if "Active," "On-Hold," or "Resign."

Click the view report to extract.

Go to export icon and select excel

Save the file. Kindly check the downloads folder for the downloaded file.

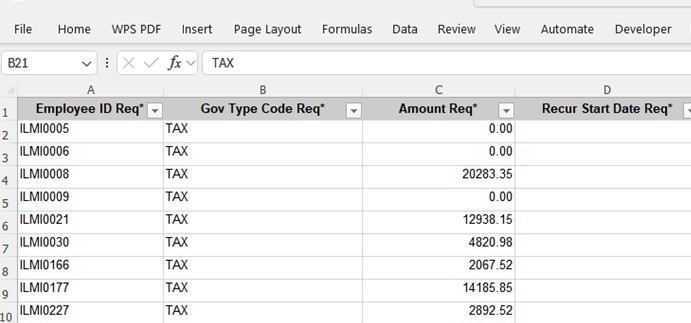

The report consists of the following details:

Company

Employee ID

Employee's Last and First Name

Date of Employment

Employee Status: Status if Active, Hold or Inactive

Prev De Minimis: De Minimis in previous employer based on the uploaded 2316.

De Minimis: De Minimis paid by his current employer.

Prev 13th Month and others: 13th month pay in previous employer based on the uploaded 2316.

Non-taxable 13th month paid: 13th month pay covered by 90k threshold.

Taxable 13th month Paid: 13th month pay in excess of 90k threshold.

90K Threshold: Other earnings under 90K Threshold or "NT 13th month and others" Category.

Projected Non-Taxable 13th month pay: For employees with projected 13th month pay below 90,000

Projected Taxable 13th month pay: For employees with projected 13th month pay that exceeds 90,000

Total 13th month pay and Others: Total of 13th month pay including the projected, previous employer 13th month pay and 90k threshold

Excess of 90k Threshold: In excess of 90k threshold

Current Month Basic: Projected basic for the month as of the current date.

For example, if the report was extracted on November 1 and no payroll was processed for the month of November, the basic income for the month of November will be reflected as "Current Month Basic."

Current Month Tx Earnings: Projected taxable recurring earnings for the month as of the current date.

For example, if the report was extracted on November 1 and no payroll was processed for the month of November, the recurring taxable earnings for the month of November will be reflected as "Current Month Tx Earnings."

Projected Month Basic: Total projected basic for the succeeding months.

Projected Month Tx Earnings: Total projected taxable recurring earnings for the succeeding months.

Gross Income: Total gross taxable income as of todate.

Gov't Contributions: Total gov't contributions as of todate.

Current Month Gov't Contribution: Projected government contribution for the month.

Projected Month Gov't Contribution: Projected government contribution for the succeeding months.

Prev Net Taxable Income: Net Taxable Income in previous employer based on the uploaded 2316.

Net Taxable: Sum of gross income plus the projected basic, 13th month pay, earnings prev taxable income less the government contributions and projected contributions (if any).

Estimated Tax Due: Tax due calculated based on the net taxable compensation.

Prev Tax Wheld: Tax withheld in previous employer based on the uploaded 2316.

Actual Tax Wheld: Total tax deducted to employee within the year.

Total Tax Wheld: Sum of prev tax and actual tax withheld.

Tax Refund: The excess in total actual tax withheld if deducted from the estimated tax due.

Tax Payable: If the total actual tax withheld is less than the estimated tax due.

Average Tax: Average tax based on the semi-monthly or monthly tax payable.

Average Net Pay: Average net pay based on the semi-monthly or monthly tax payable.

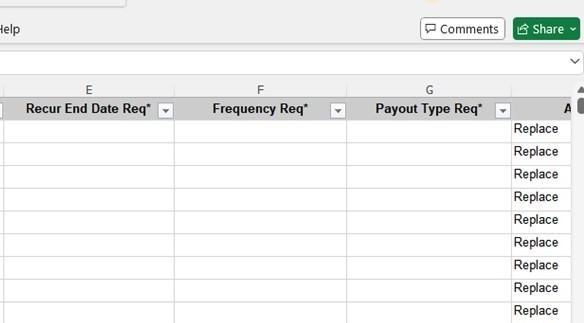

In the Annualization report, there is another sheet for govcon to upload the annualized tax in payroll, equally divided by the number of pay-outs indicated while extracting the report

(see item #3).

Recurr Start and Recurr End: Kindly indicate the recurr period or the payroll cut-off to include the annualized tax.

Frequency: Indicate the frequency, e.g 1st cut-off, 2nd cut-off, Both , 15th , 30th, etc.

Pay-out type: The payroll run type to process where the annualized tax will be included. For example, Regular, Special Run, Final Pay, 13th month

The govcon sheet should be uploaded to govcon in payroll run to be incorporated into the payroll.

Kindly click the save, and it will be saved on the left side.