A Quarterly 2307 report is a tax document in the Philippines that provides a summary of creditable income taxes withheld by a business or employer over a three-month period. It includes details such as the total amount of income subject to withholding tax, the corresponding tax withheld, and the recipient's information. This report is essential for ensuring compliance with tax regulations and is submitted to the Bureau of Internal Revenue (BIR) quarterly.

Go to AanyaHR and Login to your account.

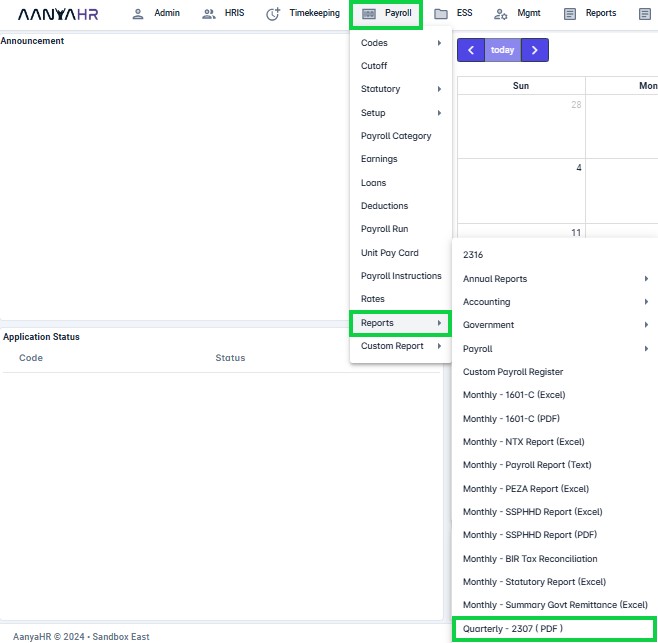

From the Payroll menu, navigate to Reports and click on Quarterly – 2307 (PDF).

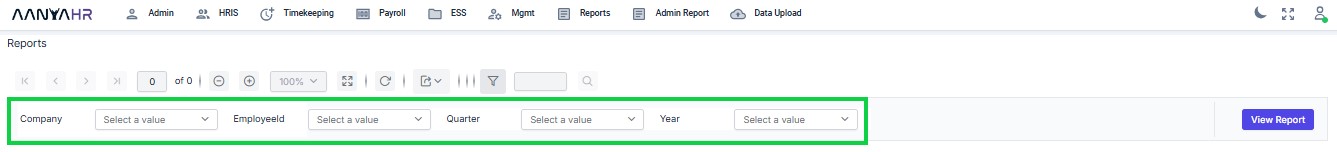

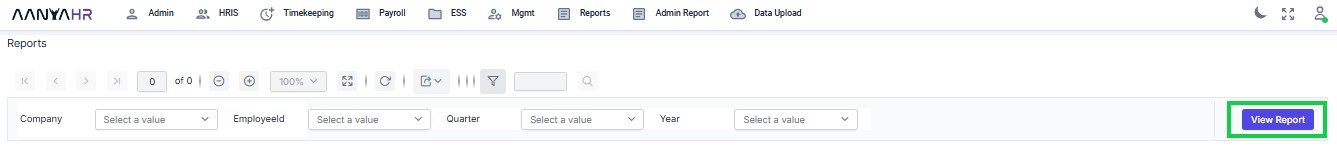

Choose a value from the dropdown list.

Company – Choose the company for which you would like to generate the report.

EmployeeId – Select the employee who's quarterly 2307 form you need to generate.

Quarter – Specify the quarter: First Quarter, Second Quarter, or Third Quarter.

Year – Enter the year for which the payroll data is being processed.

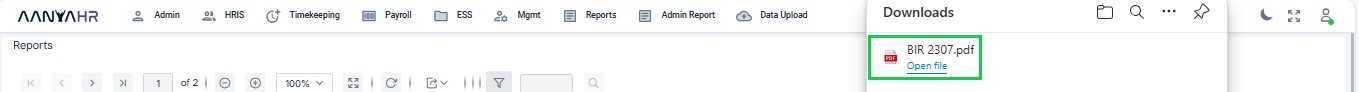

Click "View Report" to display the selected report.

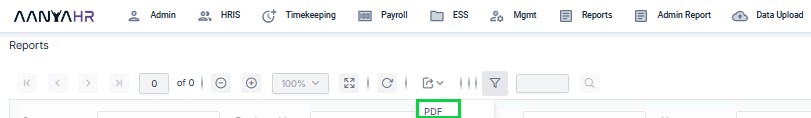

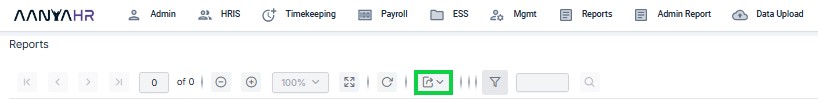

Click the “downward arrow” in the box to choose the file format for export.

Click "PDF" to export the file in PDF format.