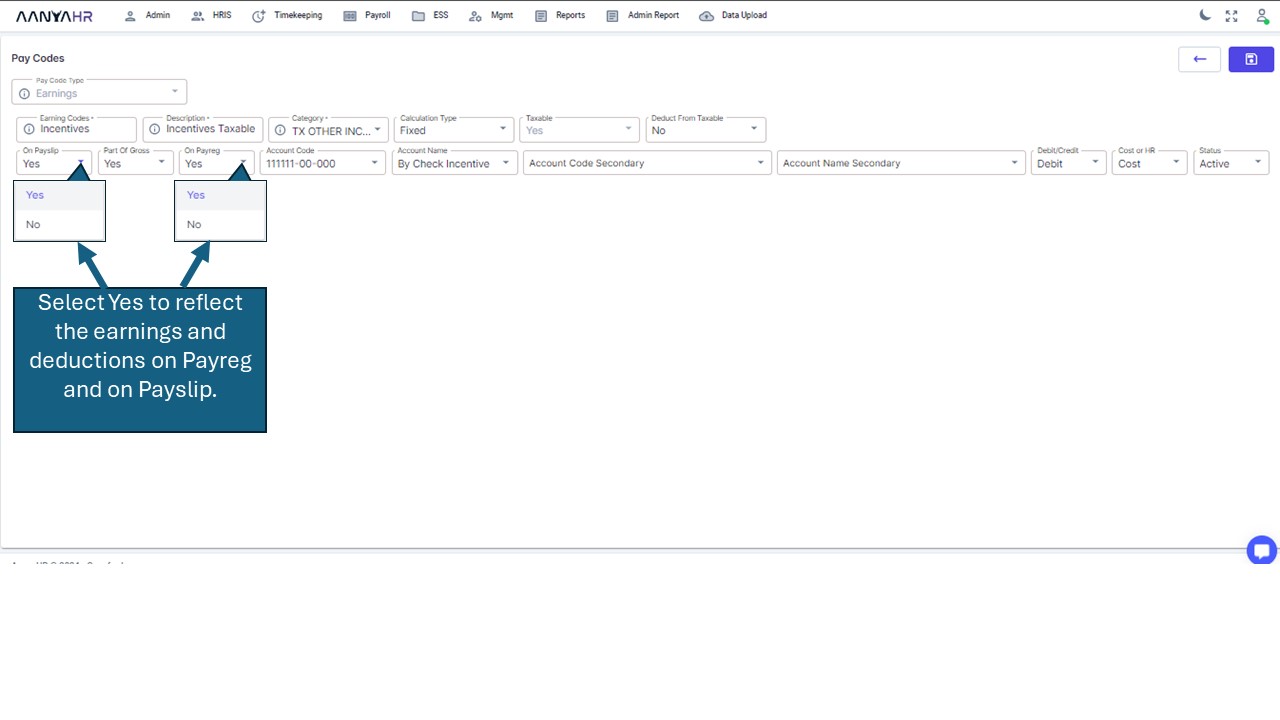

Check first the set-up of the earnings and/or deductions:

Check if the earnings and/or deductions set-up if "On Payreg" and "On payslip is enabled.

If the settings is set and the earnings or deductions still do not reflect, kindly see the other procedures below:

A. Regular Payroll

Check the recurr date of the earnings, loans or deductions to see if they still cover the processing period.

. Check the frequency of the earnings loans or deductions if it is set to the same the cut-off you are processing.

Note: For the Monthly paid employees, check the frequency. Always use Both or Every Cut-off.

For the loans, check if there is still a balance to be deducted from employee.

There are two ways to check,

Kindly go to the Payroll register LoanReg

Go to Payroll Tab ->Reports -> Payroll -> Payroll Loan History

B. Special Run

Check the frequency of the earnings, loans or deductions if it is set same as the cut-off you are processing.

Note: For the Monthly paid employees, check the frequency. Always use Both or Every Cut-off.

For the loans, check if there is still a balance to be deducted from employee.

Note: See regular Payroll on how to check the loan balances

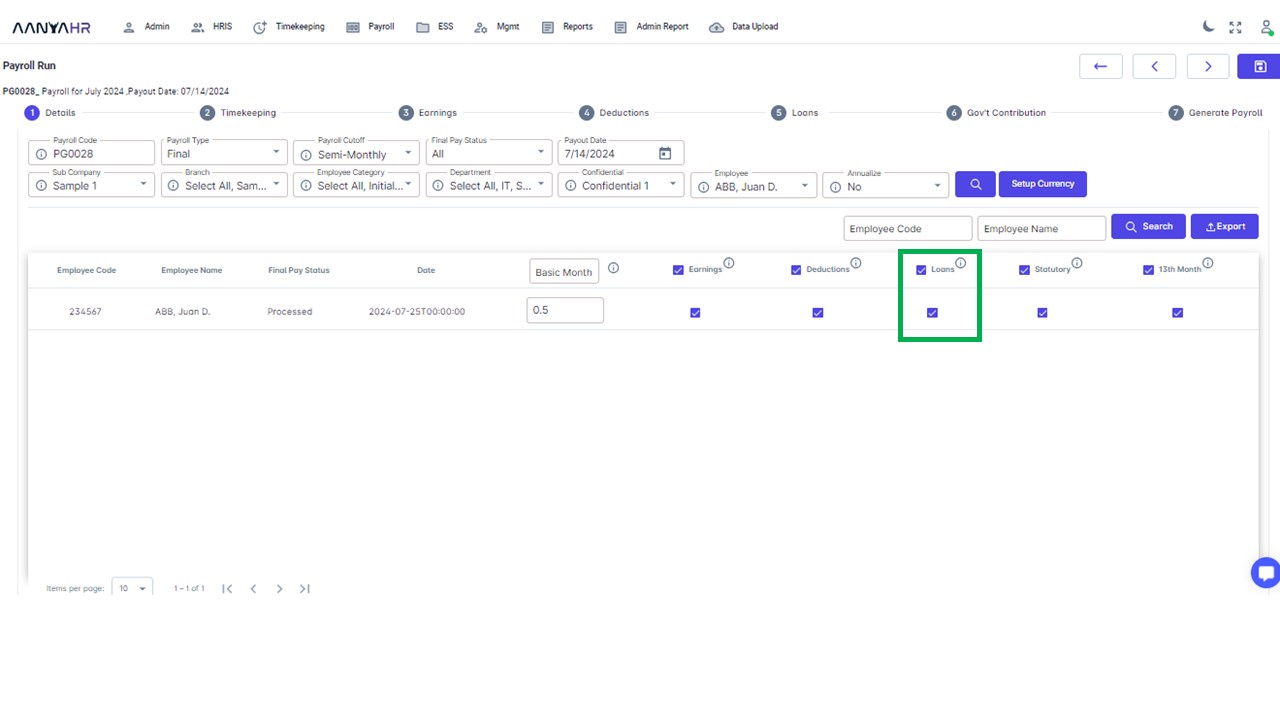

C. Final Pay

Check the recur date of the final pay, always use the final pay-out as the recur date of the earnings and deductions.

Check the Payroll type and change from Regular to Final Pay in Earnings and Deductions

Check For the frequency, always use Every-cut off or Both for Earnings, Loans and deductions

For the loans, check if there is still a balance to be deducted from employee.

Note: For the final pay, if you opt to check the loans, the total loan balance will be deducted to the employee. If you opt not to check the loan, only the monthly amortization will be deducted.

See regular Payroll on how to check the loan balances.