Go to AanyaHR and Login to your account

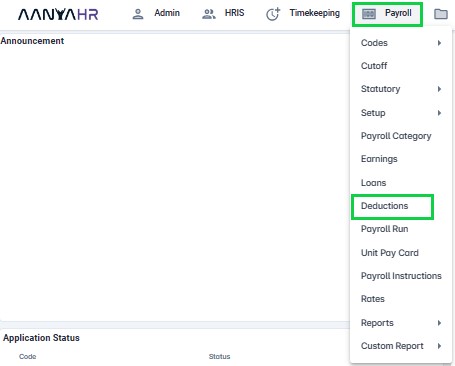

Go to Payroll > then select " Deductions ".

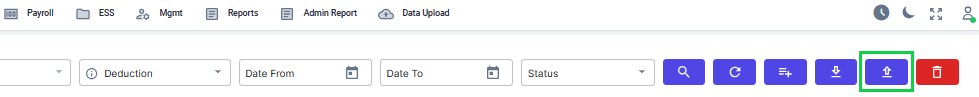

Click the “Upload” button.

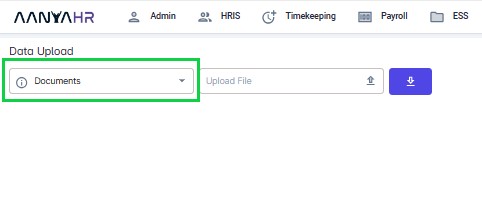

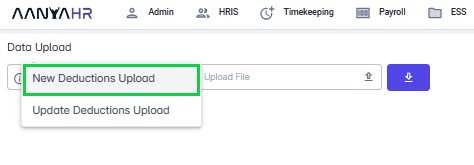

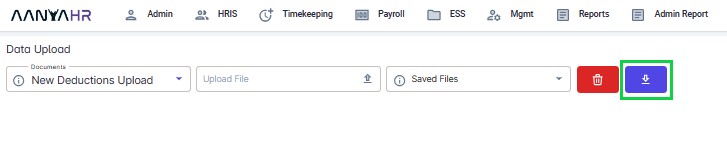

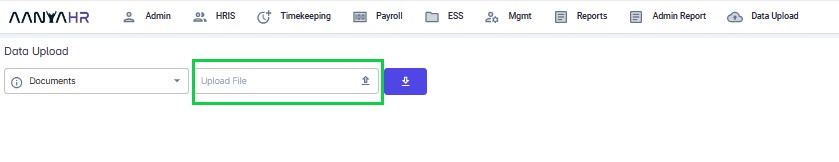

Select “New Deductions Upload” from the Documents list.

Click “Download Template” button.

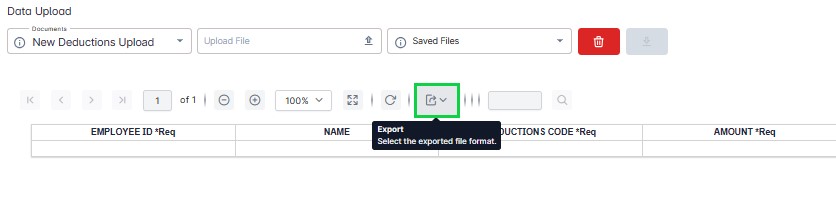

Click “Arrow down in a box” to select the exported file format.

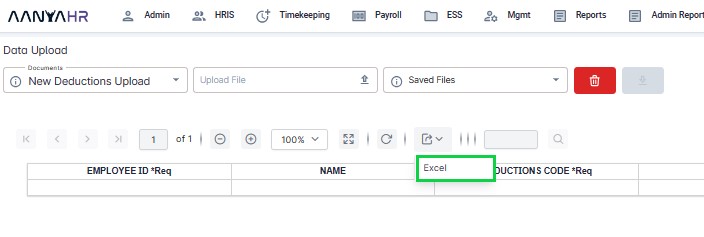

Click “Excel” to export the template.

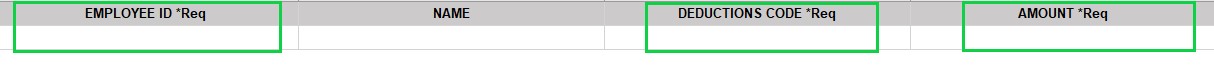

Fill out the required fields.

All with asterisk are the required fields.

*Employee ID – Input the Employee ID same with the ID in the master list from the system.

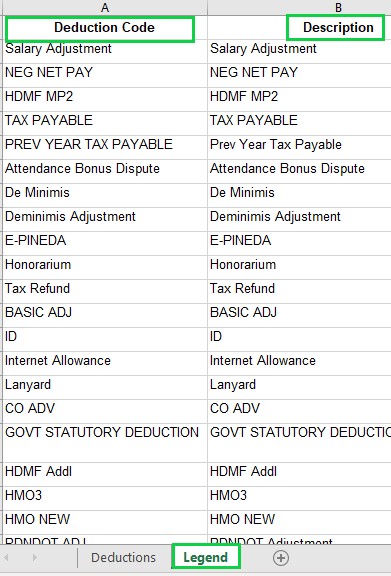

*Deductions Code – Input the Deduction code that is already set up in the system. You can also look in the Legend sheet from the excel file to make sure that the deduction code is correct.

*Amount – Input the correct amount that you wish to deduct for that employee.

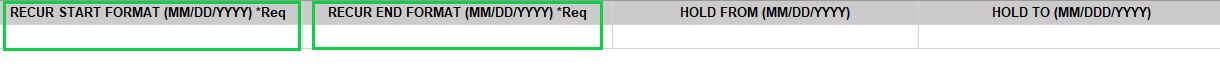

*Recur start – Input the start date of deductions in “mm/dd/yyyy” format.

*Recur end date - Input the end date of deductions in “mm/dd/yyyy” format.

Note:

For Regular Payroll: It is necessary to input the Recur Start Date and the Recur End Date.

For Final Pay and SSS Maternity: Do not input the Recur Start Date and Recur End Date.

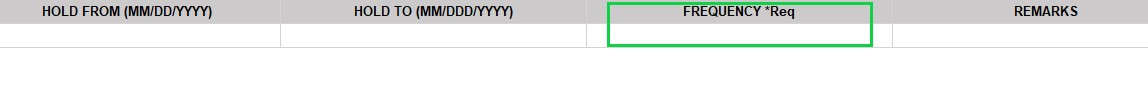

*Frequency – You may choose to these frequencies:

1. 1st – the deductions will be deducted every 1st payout.

2. 2nd - the deductions will be deducted every 2nd payout.

3. Both – the deductions will be deducted to every payout.

4. For once-a-month Payout, use “1st”.

Note:

For Special Pay and Regular Pay: You need to specify the frequency.

For Final Pay and SSS Maternity: There is no need to input a frequency.

The New Deductions Upload Template features a Legend that makes it simple to determine the exact Deduction code & Description. It will also show all the created Deduction codes.

Click “Upload” to upload the file.

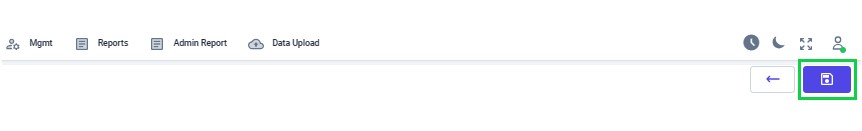

Click “Save” changes.

Go back to:

How to "Download" Deductions Template Upload in Payroll Run and fill out?