Organizing employees into categories is essential for efficient payroll processing and management. These also includes selection of Withholding tax calculation.

Here are some steps to help you achieve streamlined payroll organization:

Employee Classification:

Start by classifying your employees based on their roles, job functions, or employment status. Common categories include:

Full-time employees: Those who work regular hours and are eligible for benefits.

Part-time employees: Those who work fewer hours than full-time employees.

Contractors or freelancers: Individuals hired for specific projects or tasks.

Temporary or seasonal workers: Employees with fixed-term contracts.

Interns or trainees: Individuals gaining work experience.

Management or executive staff: Higher-level employees with specific responsibilities.

Payroll Categories:

Create pay categories that align with your employee classifications. These categories define how employees are paid. Examples include:

Regular salary: For full-time employees.

Hourly wage: For part-time or hourly workers.

Overtime pay: If applicable.

Bonuses and incentives: Additional compensation.

Commissions: For sales-related roles.

Leave categories: Sick leave, vacation days, etc.

Deductions: Tax withholdings, insurance premiums, etc.

Benefits and Deductions:

Assign benefits (such as health insurance, retirement plans, and leave accruals) to the relevant employee categories.

Remember that effective organization simplifies payroll processing, reduces errors, and ensures compliance.

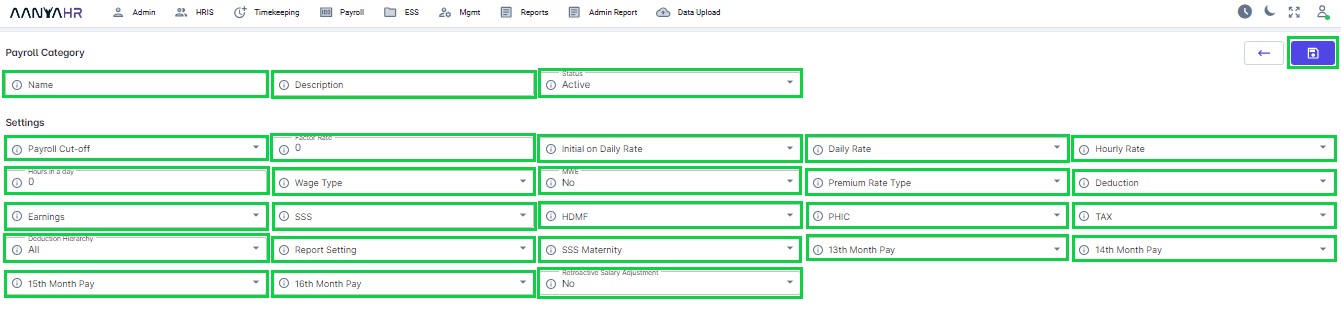

Let’s outline the steps for accurately setting up the Payroll Category in AanyaHR:

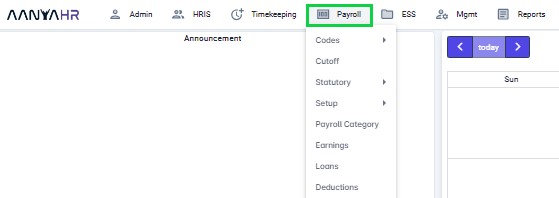

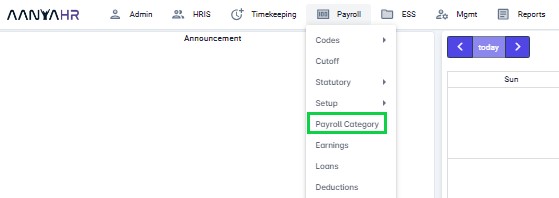

Go to Payroll > select "Payroll Category”.

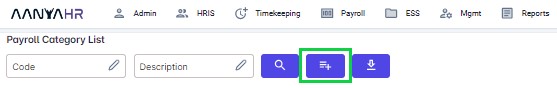

Click the “Create” button.

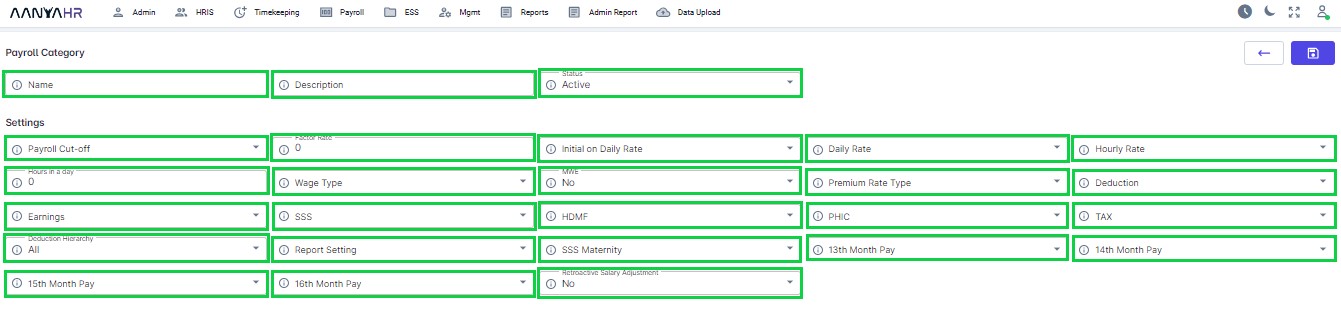

Fill out all the required fields, then click the “Save” button.

For guidance on setting up SSS Contribution, you can refer to the meaning or functions associated with tagging.

Payroll Category:

Name - a designated area where you can input a specific name for the setup.

Description - a designated portion where you can input a specific description for the setup.

Status - This may either be

Active

Inactive

Settings:

Payroll Cut-off - this dropdown refers to the cut off set up

Factor Rate - the factor rate helps determine how much an employee should be paid based on their working days in a year.

Include in Daily Rate- You have the option to choose specific pay codes that will be considered when calculating the daily rate.

Daily Rate - pertains to the calculation of the Daily Rate

Monthly Rate * 12 / Annual Working Days

ROUND (Monthly Rate * 12 / Annual Working Days, 2)

ROUND (Monthly Rate *12 / Annual Working Days)

Hourly Rate - pertains to the calculation of the Hourly Rate

Monthly Rate * 12 / Annual Working Days / Daily Hours

ROUND (Daily Rate / Daily Hours, 2)

ROUND (Monthly Rate * 12 / Annual Working Days)

Hours in a day - pertains to the total hours per day worked

Wage Type - this may be either

Daily

Hourly

Monthly

Semi-Monthly

MWE - Relating to a minimum wage earner

Yes

No

Premium Rate Type - this is related to OT Rates Set up

Deduction - related deductions pay code that may affect the calculation.

Earnings - related deductions pay code that may affect the calculation

SSS - this is related to the SSS setup

HDMF - this is related to the HDMF setup

PHIC - this is related to the HDMF setup

TAX - this is related to the HDMF setup

Deduction Hierarchy - refers to the order and precedence of payroll deductions when an employer calculates an employee’s net compensation

Report Setting - allows you to control how report readers interact with your report in various contexts.

By Calendar Month - This report covers the processed dates applied to specific start dates to end for an entire month.

By Payout Date - This report covers the processed dates applied to specific payout dates for an entire month.

SSS Maternity - This pertains to the calculation of SSS maternity benefits.

Avg. Salary Credit (Last 6mos)

Avg. Salary Credit (Top 6mos)

Current Monthly Rate

Current Monthly Rate + Recurring Earnings (NTX)

Current Monthly Rate + Recurring Earnings (TX+NTX)

13th Month Pay - This pertains to the calculation of 13th Month Pay.

Retroactive Salary Adjustment - Retroactive salary adjustment, also known as retro pay, refers to compensation that is due for a period before a salary increase or adjustment takes effect. The setup is either:

Yes - AanyaHR will calculate automatically the salary adjustments from the start date of the salary increase or from the effective date of the adjustment or salary increment.

No - the system will not calculate any adjustments.

New Hire Prorated Reg Days - New Hire Prorated Reg Days refer to the adjustment of certain benefits or entitlements for employees who are newly hired during a calendar year. The setup is either:

Yes

The system is designed to automatically determine the exact number of days that the newly hired employees have been present per the timekeeping uploaded.

AanyaHR will calculate their pay by multiplying the actual total days present by the daily wage rate, as prorated calculation.

The specified sum will appear as BASIC in the payroll register, for the particular pay period in which the employees were hired.

The Pay register will not show any deductions of absences.

No

The Newly hired employee/s will be paid the full amount of his/her monthly or semimonthly Basic Salary if no absences reflected on his/her Timekeeping.

AanyaHR will not pro-rate the pay.

Go back to: