Payroll cut-offs are essential for managing employee salaries and ensuring accurate payments. Let’s break down the process:

Understanding Payroll Cut-Offs:

A payroll cut-off refers to the specific period during which you collect and process employee data for salary computation.

It determines which days’ work or attendance will be included in a particular pay cycle.

Setting Up Payroll Cut-Offs:

Frequency: Decide how often you’ll run payroll (e.g., monthly, biweekly, or semimonthly).

Cut-Off Dates: Determine the start and end dates for each pay period. Common cut-off dates include:

1st to 15th: Employees are paid on the 30th or 31st of the month.

16th to end of the month: Employees are paid on the 15th of the following month.

5th to 20th: Employees receive their salary on the 5th of the next month.

21st to 5th: Employees receive their salary on the 20th of the next month.

Collecting Employee Data:

During the cut-off period, gather relevant information:

Work Hours: Record the hours worked by each employee.

Leaves and Absences: Note any leaves, holidays, or unpaid days.

Overtime: Include any overtime worked.

Processing Payroll:

Calculate each employee’s earnings based on the data collected.

Deduct taxes, contributions, and other withholdings.

Generate paychecks or direct deposits.

Communication and Documentation:

Inform employees about their pay dates and cut-off periods.

Provide pay slips detailing earnings, deductions, and net pay.

Remember to consult your company’s policies and local labor laws. If you’re unsure, reach out to your payroll department for guidance.

Let’s outline the steps for creating cut off in AanyaHR:

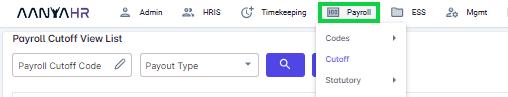

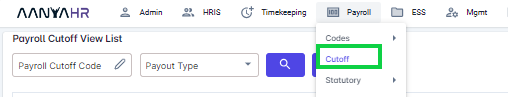

Go to Payroll > select "Cutoff”.

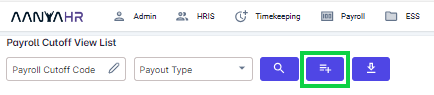

Click the “Create” button.

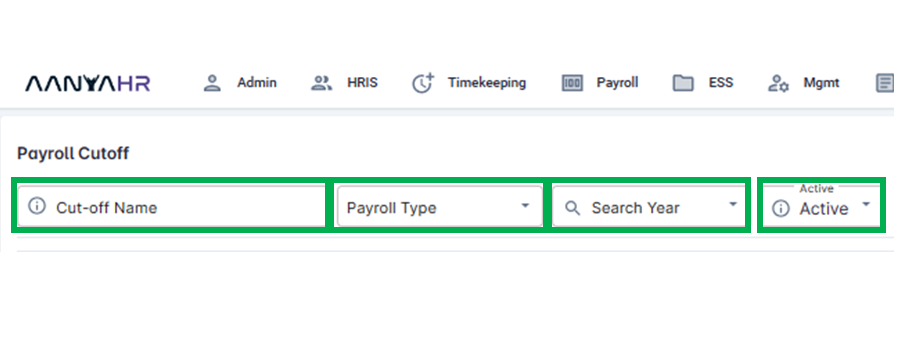

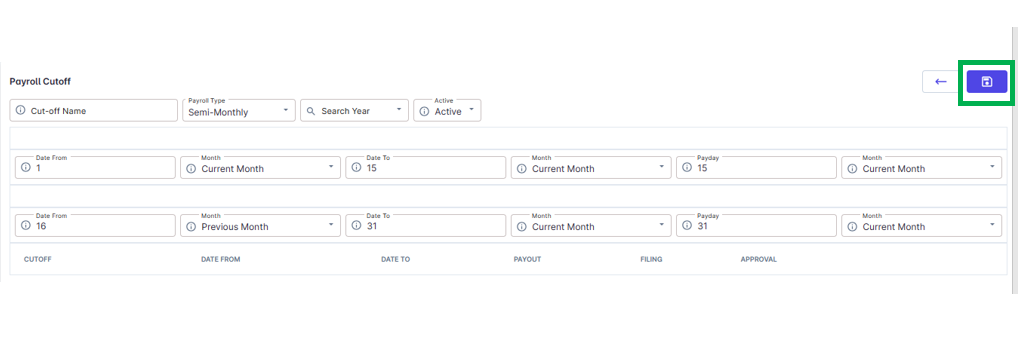

Fill out the necessary details below:

For guidance on the tabs shown, you can refer to the meaning or functions associated with tagging.

Cut-off Name - preferred Cut-off Name

Payroll Type - Payroll types such as Monthly, Semi-monthly, Weekly, or Daily

Payroll Cut Off - Semi-Monthly, Monthly, or Daily

Search Year - Remember to select the applicable year for the payroll cut-off to be created. [Required]

Active - it's either Active or Inactive

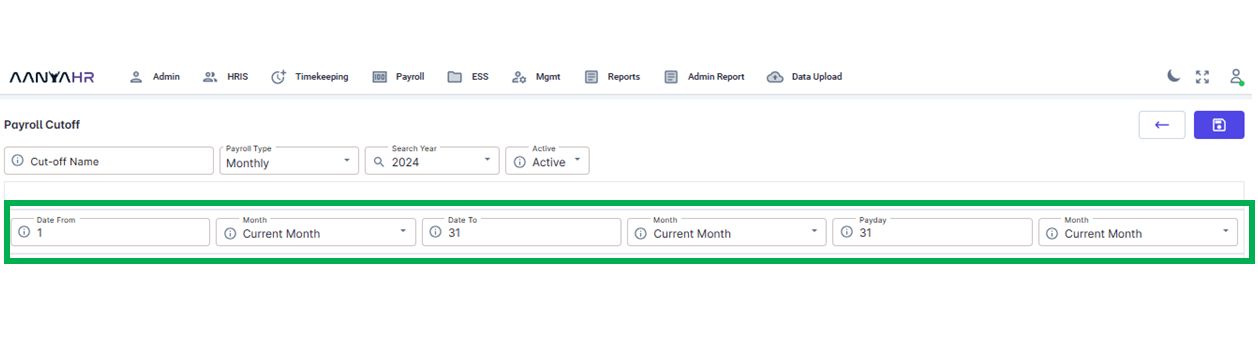

If you are creating for the Monthly Payroll Cut-off you may refer to these tags:

Date From - Start date of the cutoff.

Month - Applicable Month for the Start date of the 1st cut-off. This may be either Previous Month, Current Month or Next Month

Date To - Last date of First cut-off.

Month - Applicable Month for the Start date of the cut-off. This may be either Previous Month, Current Month or Next Month

Payday - payout date of the cut-off

Month - Applicable month for the pay-out date of the cut-off

Month - Applicable Month for the Start date of the cut-off. This may be either Previous Month, Current Month or Next Month

Date To - The last date of the cut-off.

Month - Applicable Month for the Start date of the cut-off. This may be either Previous Month, Current Month or Next Month

Payday - payout date of the cut-off

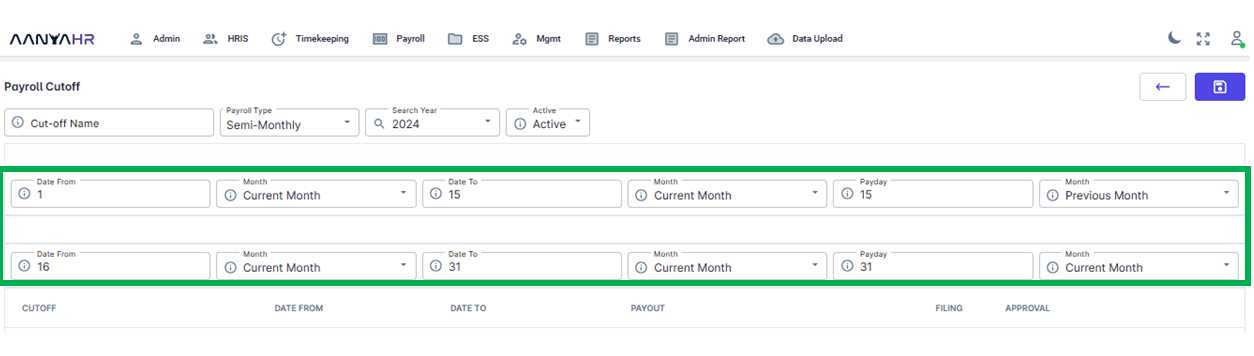

If you are creating for the Semi- Monthly Payroll Cut-off you may refer to these tags:

Date From - Start date of the 1st cutoff.

Month - Applicable Month for the Start date of the first cut-off. This may be either Previous Month, Current Month or Next Month

Date To - Last date of First cut-off.

Month - Applicable Month for the Start date of the first cut-off. This may be either Previous Month, Current Month or Next Month

Payday - payout date of the first cut-off

Month - Applicable month for the first pay-out date of the first cut-off

Date From - Start date of the second cutoff.

Month - Applicable Month for the Start date of the second cut-off. This may be either Previous Month, Current Month or Next Month

Date To - Last date of second cut-off.

Month - Applicable Month for the Start date of the second cut-off. This may be either Previous Month, Current Month or Next Month

Payday - payout date of the second cut-off

Month - Applicable month for the first pay-out date of the second cut-off.

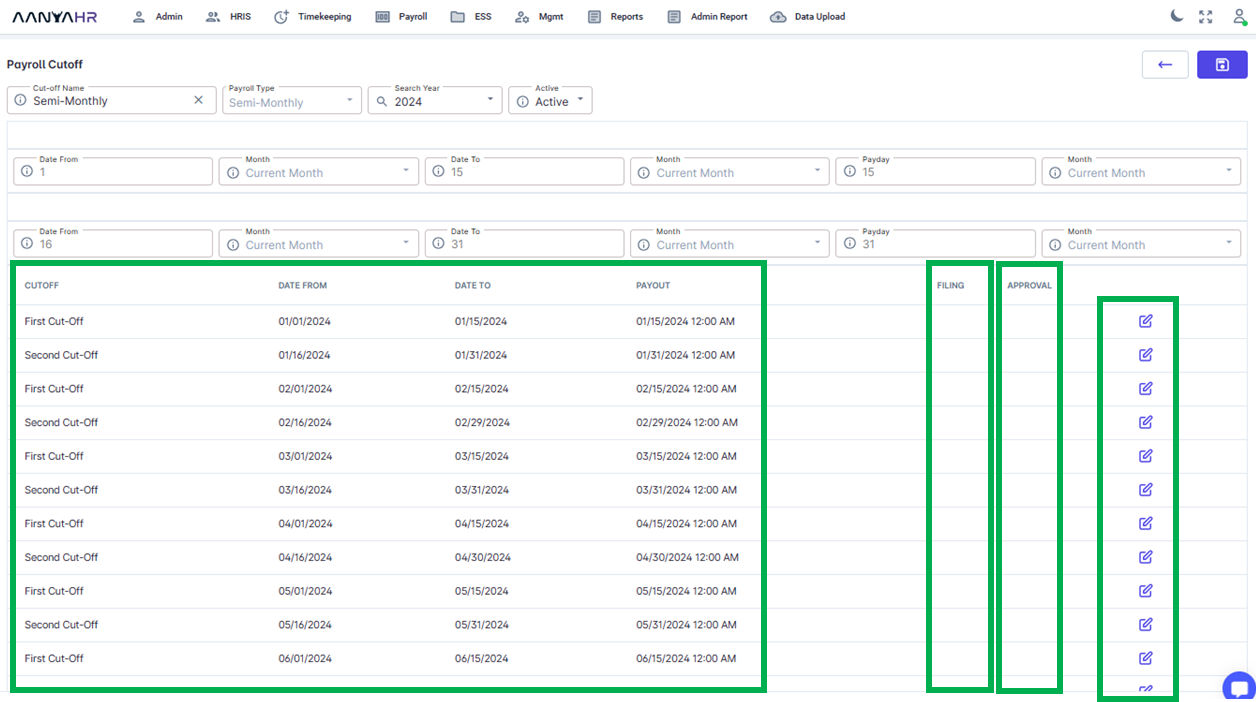

Created cut-off details will be automatically reflected in the columns below.

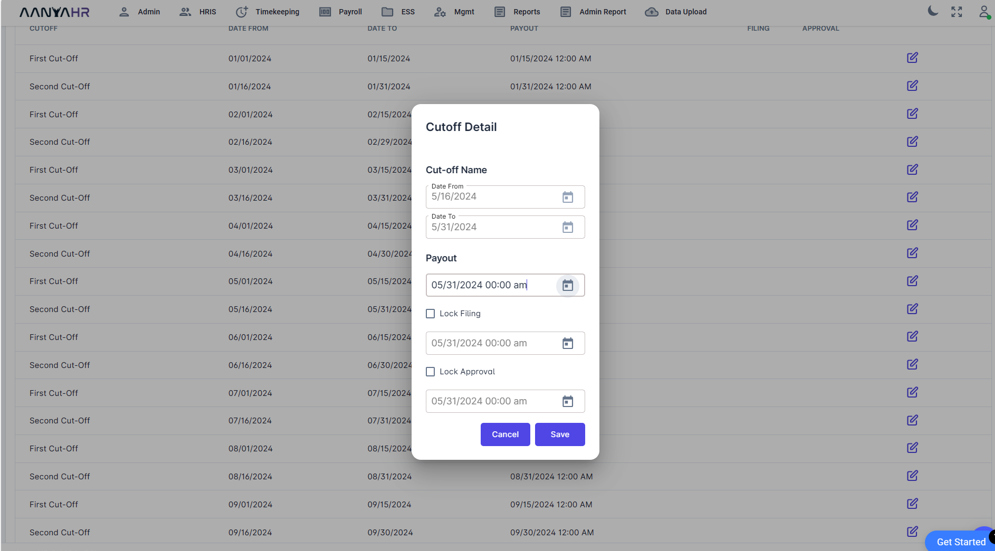

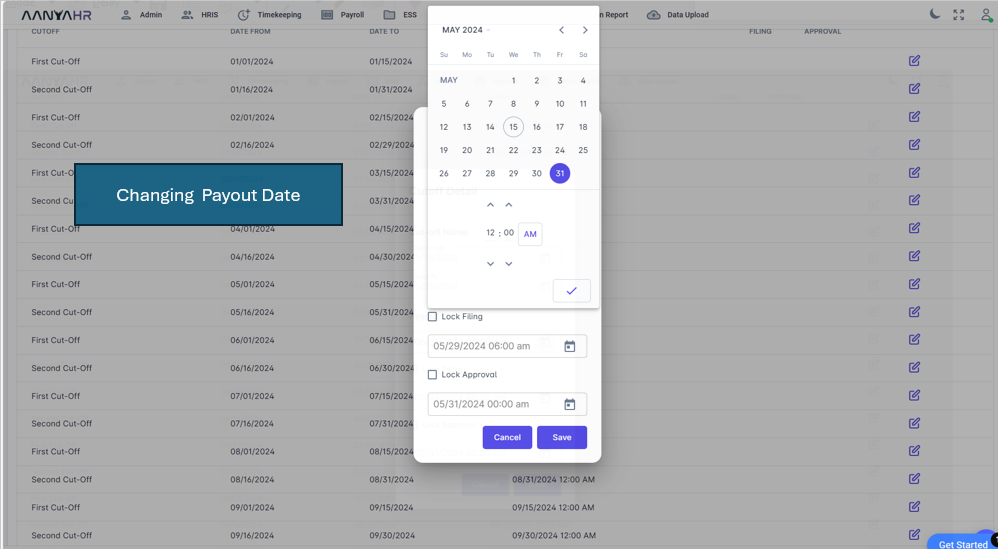

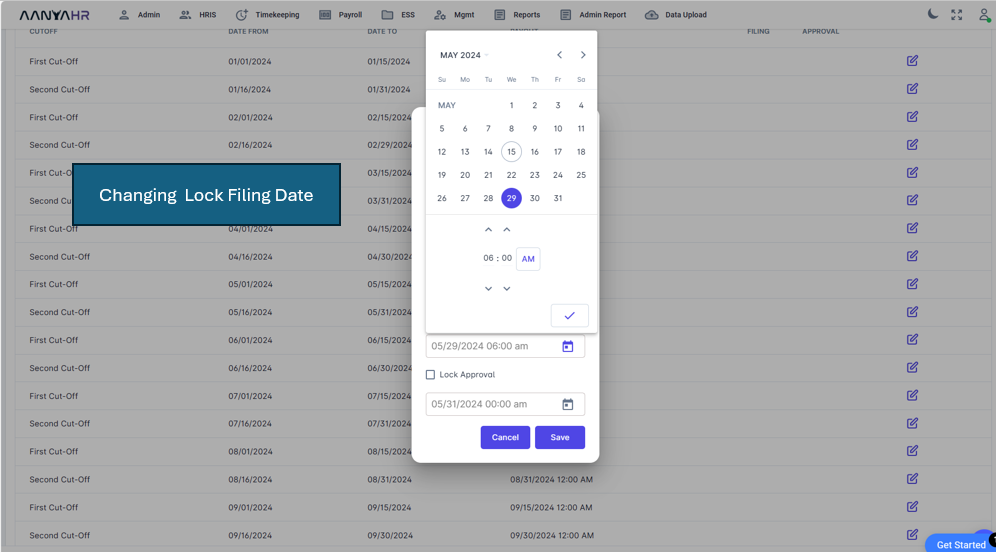

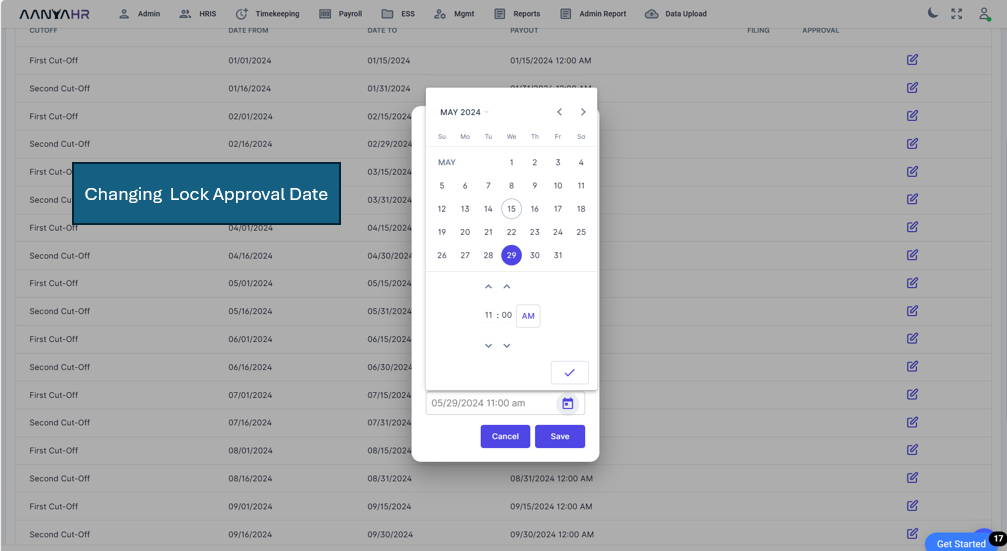

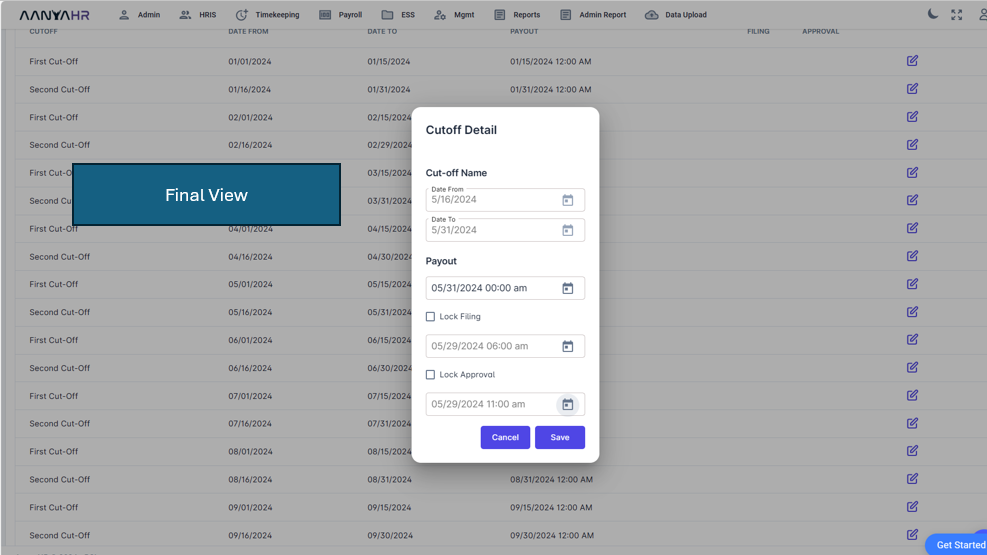

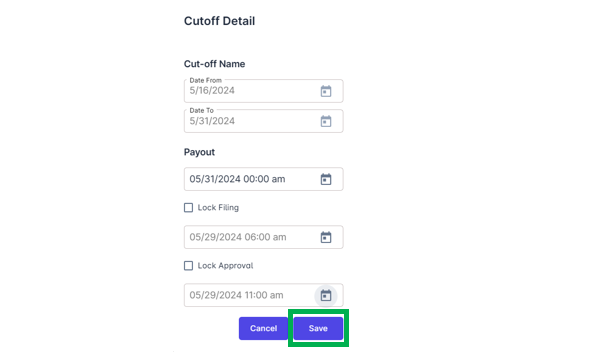

When you click the pen icon, you’ll discover the precise cut-off details. You can configure the lock filing date and approval date for timekeeping using this feature.

You also have the option to modify the payout date.

You also have the option to modify the Lock filing date.

Changing the Lock approval

Below is the final view of the setup for the Timekeeping locking and approval dates.

Click the save icon to save the cut-off details.

Click the save icon to store the created payroll cut-off.

Go back to :