To ensure an accurate Loan Codes setup, follow the steps outlined below:

Go to AanyaHR and log in to your account.

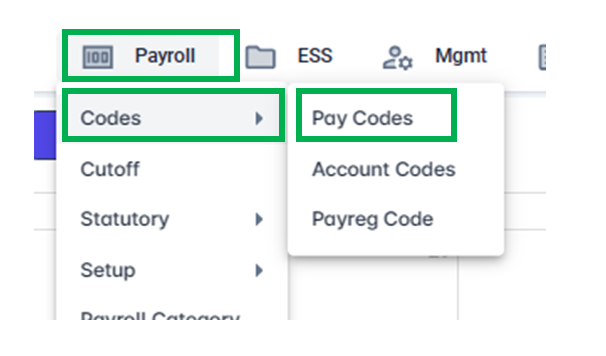

Go to Payroll > click "Codes" then select "Pay codes".

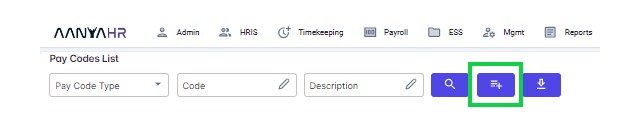

Click the “Create” button.

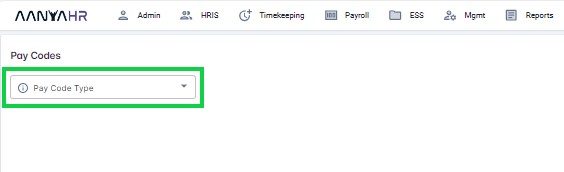

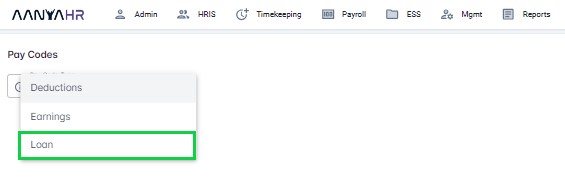

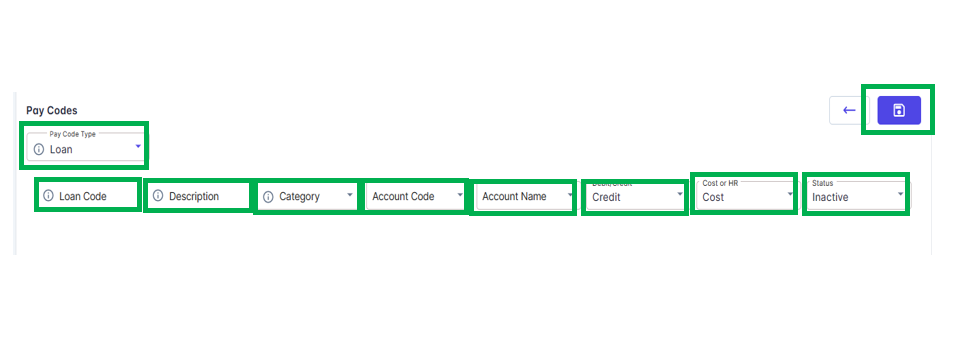

Select “Loan” from the Pay Code Type list.

Fill out all the required fields, then click the “Save” button.

For guidance on creating Loan Codes, you can refer to the meaning or functions associated with tagging.

Loan Code - Create a preferred loan code. [Required]

Description - preferred description for the Loan Code to be created.

Category - to choose the for what loan code you are creating. [Required]

When adding a loan code to the system, it is vital to select the appropriate Category from the dropdown menu to ensure that the loan deductions are correctly processed and reflected in government compliance reports.

Each category likely corresponds to different types of government-mandated loan programs, such as those managed by the Home Development Mutual Fund (HDMF) or Social Security System (SSS).

Account Code - The accounting codes that we typically use in our journal entries and general ledgers, along with the account names, are called Account Code. For simpler reporting, AanyaHR is furnished with accounting reports in addition to payroll and timekeeping reports.

Account Name - Account names are the titles assigned to particular codes in reports, like General Ledgers and Journal Entries. For simpler reporting, AanyaHR is furnished with accounting reports in addition to payroll and timekeeping reports.

Debit / Credit - where the loan code will reflect in journal entry.

Cost or HR – if the earnings is for costing or HR.

Status – to set if the earnings will be an Active earnings code or Inactive earnings code.

Active loan code and can be used in every transaction

Inactive loan code it cannot be used in any transaction

Account Codes - To include the specific account code for earnings, deductions, loans, and

Pay reg Codes – the payroll codes that can be used and seen in payroll registers.

Pay Codes are also known as pay categories or wage types, serve as unique identifiers assigned to specific components of an employee’s compensation. These codes help employers classify and track various aspects related to payroll, such as earnings, deductions, and other payroll-related transactions.

After you’ve completed all the necessary details, you can save the newly created Earning code by clicking the save icon.

Go back to :