To ensure an accurate Deduction Codes setup, follow the steps outlined below:

Go to AanyaHR and log in to your account.

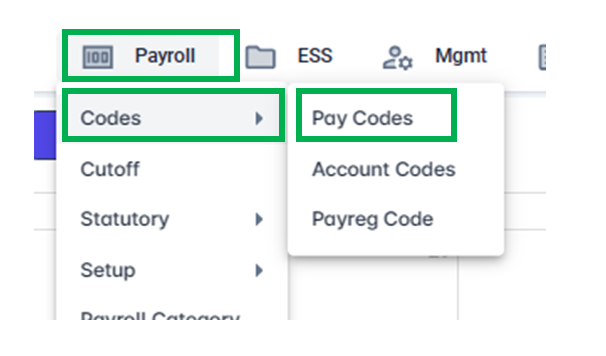

Go to Payroll > click "Codes" then select "Pay codes".

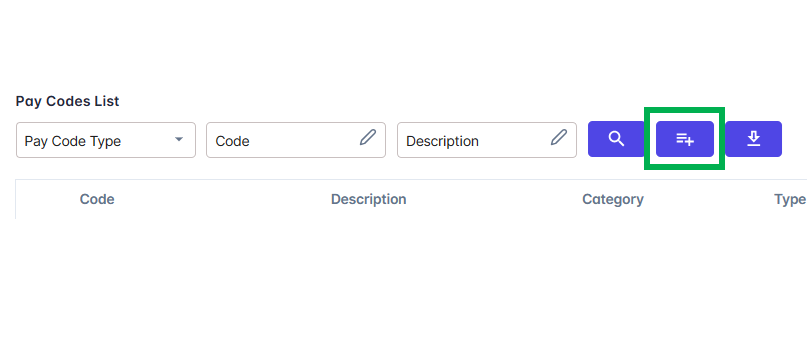

Click on the Create button to start creating a certain code that will be used in payroll.

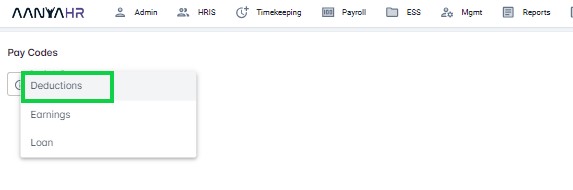

Select “Deductions” from the Pay Code Type list.

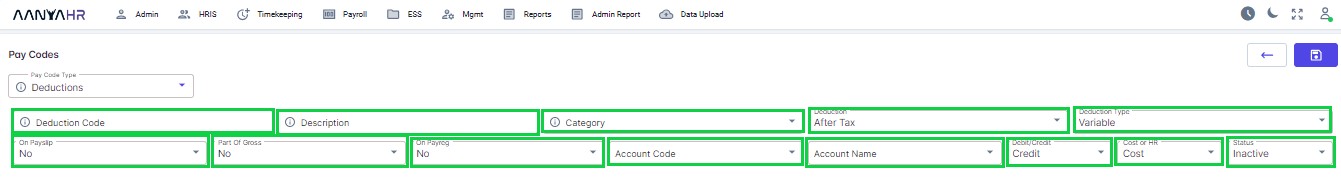

Fill out all the required fields, then click the “Save” button.

For guidance on creating a Deductions Code, you can refer to the meaning or functions associated with tagging.

Deduction Code – create a preferred name for the deduction code. [Required]

Description – preferred description for the deduction code to be created.

note: It can be the same as the deduction code.

Category – Here you can choose the appropriate classification to which a particular pay code belongs. This allows you to organize and manage pay codes effectively.

Company – used as a deduction intended for the company.

Government – used for deduction intended for the government.

Bank – used for deductions intended for the bank.

Deduction – The deduction created will be subtracted either before or after the tax deduction.

Deduction Type – to choose if the deduction is either Fixed or Variable

Fixed deduction that can be set eventually while creating the deduction code.

Variable deduction any amount can be uploaded.

On Pay slip – to reflect or not the deduction code you are creating in Payslip.

Part of Gross – to choose if the deduction code to create is a part of the gross taxable income or not.

On Payreg – if the deduction is to be created will reflect in the Payroll Register.

Account Code - The accounting codes that we typically use in our journal entries and general ledgers, along with the account names, are called Account Code. For simpler reporting, AanyaHR is furnished with accounting reports in addition to payroll and timekeeping reports.

Account Name - Account names are the titles assigned to particular codes in reports, like General Ledgers and Journal Entries. For simpler reporting, AanyaHR is furnished with accounting reports in addition to payroll and timekeeping reports.

Debit / Credit – where the deduction code will reflect in the journal entry.

Cost / HR – if the deduction is for Costing or HR.

Status – to set if the deduction will be an Active deduction code or an Inactive deduction code.

After you’ve completed all the necessary details, you can save the newly created Pay codes by clicking the save icon.

Go back to :