Properly managing withholding tax ensures compliance and avoids penalties. When it comes to withholding tax calculations, avoiding mistakes is crucial to ensure compliance and prevent legal repercussions. To minimize mistakes, follow these best practices:

Know the Regulations: Familiarize yourself with Philippine payroll regulations and company policies.

Accurate Employee Data: Ensure that all employee data used in calculations (such as income, allowances, and exemptions) are accurate.

Stay on Top of Deadlines: Be aware of payroll deadlines for payouts, government reports, and tax remittances.

Regular Internal Audits: Conduct regular internal audits to catch any discrepancies.

Paying withholding taxes correctly and promptly is essential to avoid legal repercussions. Whether due to human error or intentional actions, the consequences can be damaging to your business’s reputation and financial standing.

Let’s outline the steps for accurately setting up Withholding Tax deductions in AanyaHR:

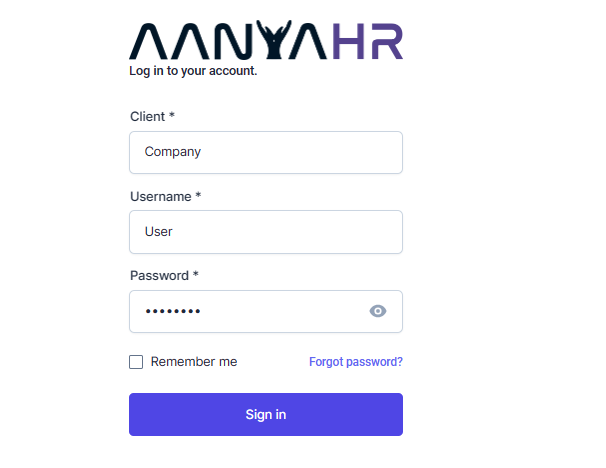

Go to AanyaHR and Login to your account.

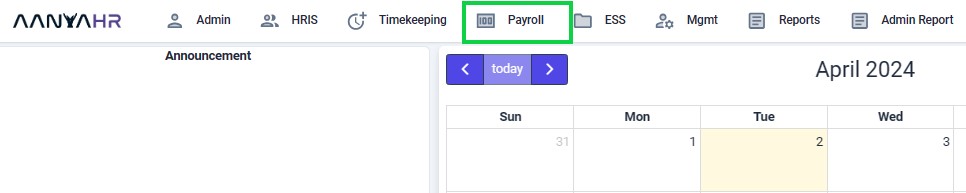

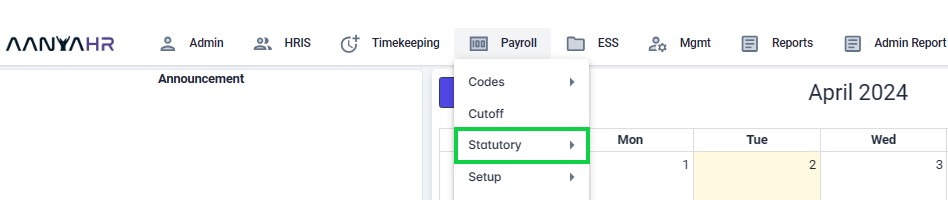

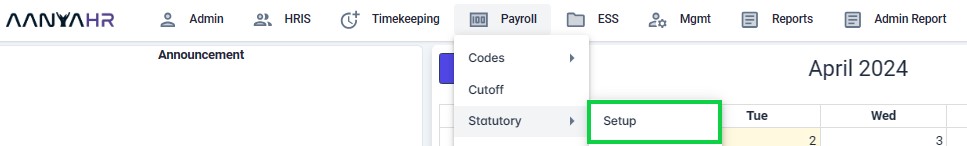

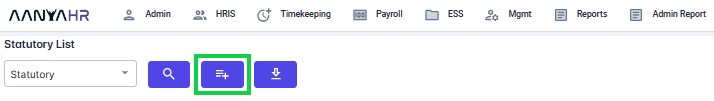

Go to Payroll > click "Statutory" then select "Setup".

Click the “Create” button.

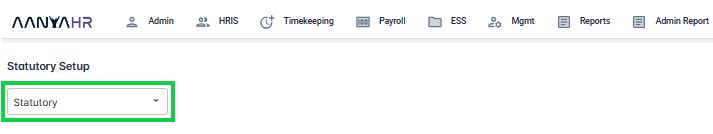

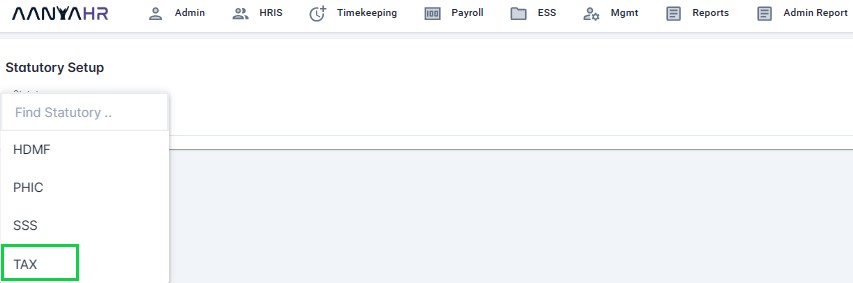

Click the “Statutory” dropdown list, then select TAX.

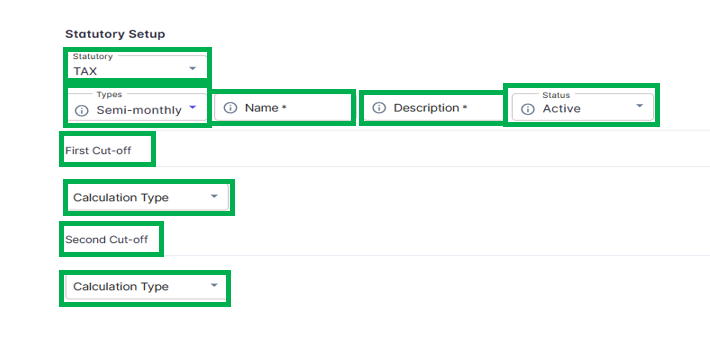

Fill out all the required fields, then click the “Save” button.

For guidance on setting up SSS Contribution, you can refer to the meaning or functions associated with tagging.

Statutory - you may select here the specific statutory to set up.

HDMF

PHIC

SSS

TAX

Types - this dropdown refers to the Wage Type

Monthly

Semi-Monthly

Weekly

Name - Within AanyaHR, a designated area where you can input a specific name for the setup. A predefined default names have already been set up.

Description - a designated area where you can input a specific description for the setup.

Monthly

Semi-Monthly

TAX

Status - This may either be

Active

Inactive

First Cut off - You have the option to choose from the following selections.

Calculated

Tax Rate

Contractor 10%

Contractor 5%

Monthly Tax Table ADJ from 1st cut-off

Semi-Monthly Tax Table

Fixed

Max Amount

Fixed - with Maximum Amount

Not Applicable

Inactive

Second Cut off - You have the option to choose from the following calculation type.

Adjustment from the 1st cut off

Contractor

10%Contractor

5%Monthly Tax Table

Monthly Tax Table ADJ from 1st cut-off

Calculated

Contractor 10%

Contractor 5%

Monthly Tax Table

Monthly Tax Table ADJ from 1st cut-off

Not Applicable

Go back to :