Contributing to Pag-IBIG (HDMF) offers several benefits for its members. Members are entitled to participate in Pag-IBIG’s programs and activities. These include housing fairs, seminars, and other events that provide valuable information and networking opportunities.

Here are some key advantages of the HDMF members:

Housing Loans

Savings and Dividends

Retirement Fund

Short-Term Loans

Membership Benefits

Here are the steps to accurately set up HDMF statutory deductions based on company preferences:

Understand company preferences.

Gather necessary information.

Calculate employee and employer contributions.

Configure your payroll system.

Maintain accurate records.

Let’s outline the steps for accurately setting up HDMF statutory deductions in AanyaHR:

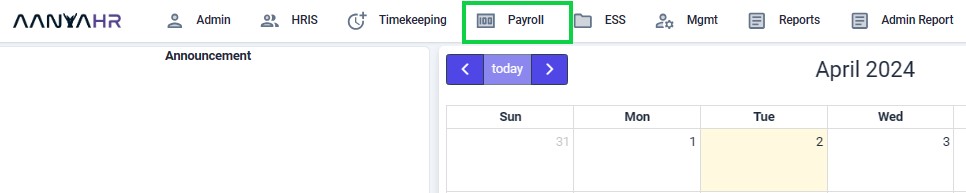

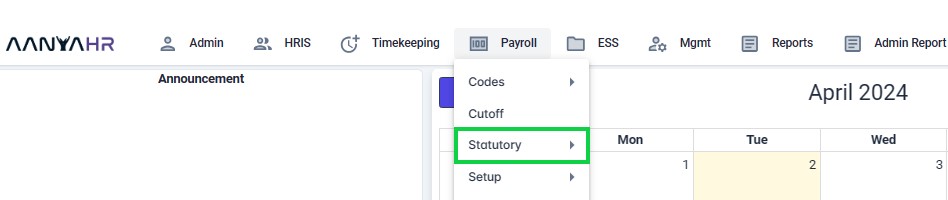

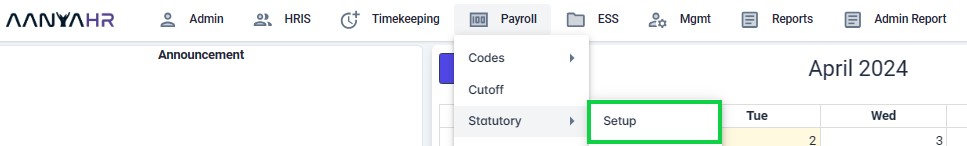

Go to Payroll > click "Statutory" then select "Setup".

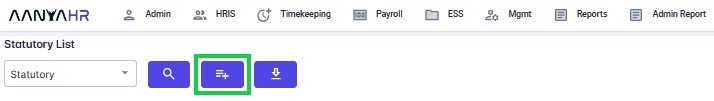

Click the “Create” button.

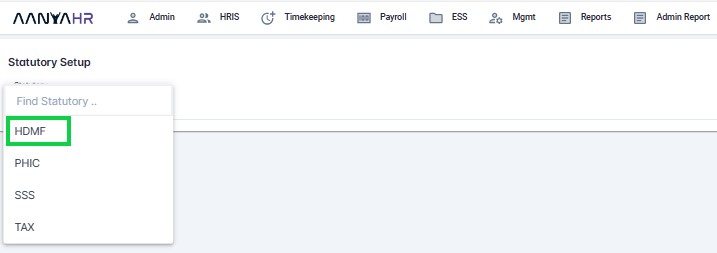

Click the “Statutory” dropdown list, then select HDMF.

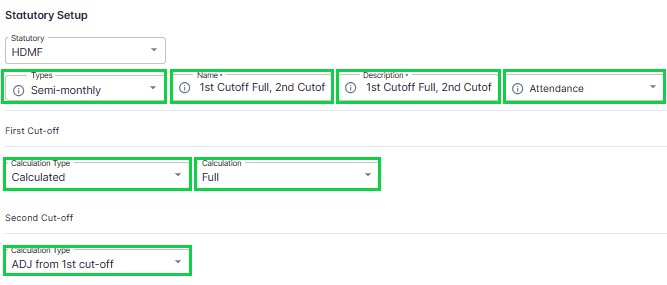

Fill out all the required fields, then click the “Save” button.

For guidance on setting up SSS Contribution, you can refer to the meaning or functions associated with tagging.

Statutory - you may select here the specific statutory to set up.

HDMF

PHIC

SSS

TAX

Types - this dropdown refers to the Wage Type

Monthly

Semi-Monthly

Weekly

Name - Within AanyaHR, a designated area where you can input a specific name for the setup. A predefined default names have already been set up.

Description - a designated area where you can input a specific description for the setup.

Monthly

Semi-Monthly

TAX

Attendance - Within AanyaHR, you have the option to choose attendance-based calculations that can impact the overall calculations.

All

Absence

Leave without pay

Regular Days

Tardiness

Undertime

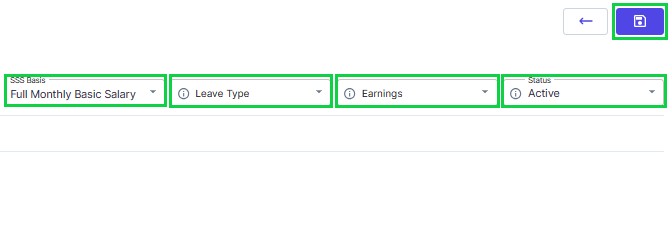

SSS Basis- this dropdown refers to the Wage Type. You have the option to choose from the following selections.

All

Basic of Current Pay out

Full Monthly Basic Salary

Holiday

Overtime

Leave Type - this pertains to all leave requests submitted within the company, which can impact the calculations.

Annual Leave

Maternity Leave

Magna Carta of Women

Medical Leave

Sick Leave

Solo Parent Leave

Vacation Leave

VAWC

Service Incentive Leave

Earnings - this pertains to all Earnings Pay codes within the company, which can impact the calculations.

Basic Salary Adjustment

OT Adj

SL Conversion

Maternity Benefit

Maternity Benefit Salary Deferential

Other earnings to be added

Overtime

Status - This may either be

Active

Inactive

First Cut off - You have the option to choose from the following selections.

Calculated

Full

Half

Half Pro-rated

Maximum

Fixed - with Maximum Amount

Not Applicable

Inactive

Second Cut off - You have the option to choose from the following calculation type.

Adjustment from the 1st cut off

Calculated

Fixed

Not Applicable

Go back to: