In the Philippines, statutory contributions refer to mandatory financial contributions made by both employers and employees to government agencies. These contributions ensure that workers have access to essential benefits and protections. 1. Social Security System (SSS): Employers and employees are required to contribute to the SSS. The SSS provides social security benefits, including retirement, disability, sickness, maternity, and death benefits. It helps safeguard employees’ financial well-being throughout their working lives1. 2. PhilHealth: Employers and employees also contribute to PhilHealth. This national health insurance program ensures that employees have access to affordable healthcare services. It covers hospitalization, outpatient care, and preventive services. 3. Pag-IBIG Fund: Employers must register with the Pag-IBIG Fund and contribute on behalf of their employees. The fund provides housing loans, savings programs, and other benefits related to housing and real estate financing2. These statutory contributions are crucial for protecting employees’ rights and providing them with financial security. Employers play a vital role in deducting and remitting these contributions to the respective government agencies3. If you’re an employer, make sure to comply with these requirements to support your workforce effectively. Setting up statutory contribution calculations in AanyaHR is a key step in ensuring your payroll system aligns with legal requirements and supports your employees' benefits effectively.

Go to AanyaHR and Login to your account.

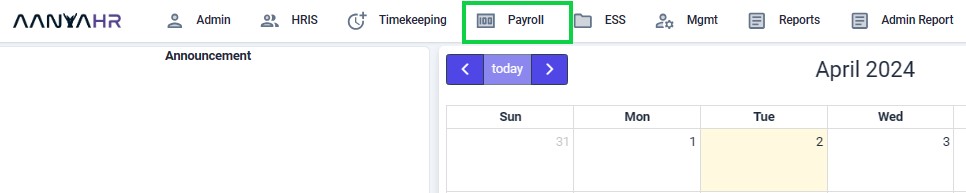

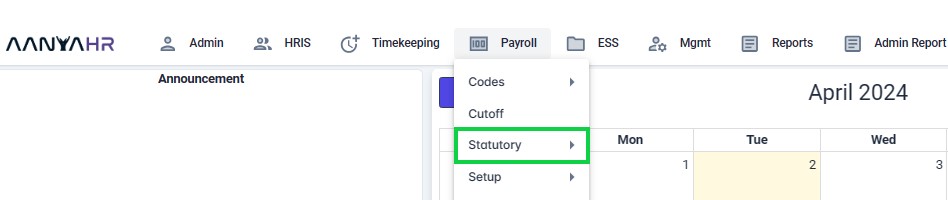

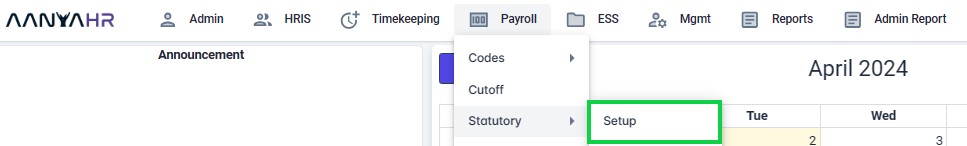

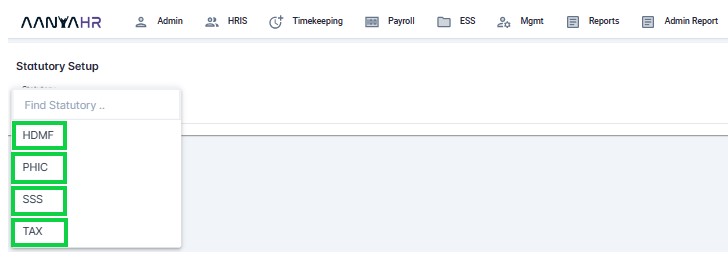

Go to Payroll > click "Statutory" then select "Setup".

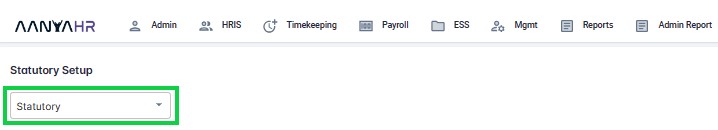

Click the “Statutory” dropdown list, then select which Statutory (HDMF, PHIC, SSS, or TAX) you want to set up.

Note:

The statutory standard policy has already been set up in the system. You can add another one if it is not yet available here.

Click on the links below:

How to set up Statutory for HDMF

How to set up Statutory for PHIC