Pay Register Codes refer to specific designations used in payroll systems to categorize and track different types of income that employees receive. These codes play a crucial role in calculating compensation, reporting, and ensuring accurate payments. These also include parameters related to accounting rules, tax laws, reporting requirements, and gross-up capabilities. Common examples of pay register codes include:

1. Regular Earnings: Represents regular pay for work performed during a given pay period. Please examples below:

*Salary: The amount an employee gets paid for the pay period.

*Hourly Rate: The employee’s hourly rate.

*Overtime (OT): Compensation for hours worked beyond regular working hours.

2. Payroll deduction codes: play a crucial role in managing employee compensation and ensuring accurate payroll processing. These codes represent specific deductions taken from an employee’s gross pay. Please see examples below:

*Mandatory Deductions/Government Contributions

Employers are legally required to deduct specific items from employee salaries each month:

Employee’s Share of SSS, PhilHealth, and Home Development Fund (HDMF)/Pag-IBIG Contributions:

These deductions contribute to social security, health insurance, and housing programs.

Withholding Tax: The amount withheld for the taxes.

*Loan Payments: Deductions related to employee loans.

*Tardiness and Absences: Penalties for late arrivals or missed workdays.

*Other Deductions: Company-specific policies may lead to additional deduction.

How to view Pay Reg Codes in AanyaHR

Go to AanyaHR and log in to your account.

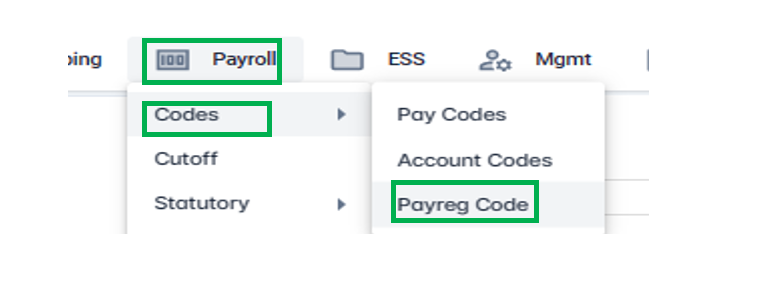

Go to Payroll > Codes > Click Payreg Code

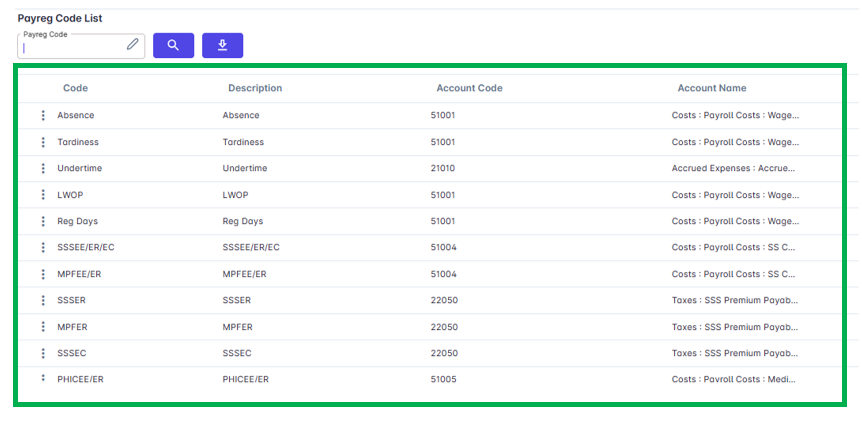

Payroll Register Codes will be displayed along with their specific descriptions, as well as the corresponding Account Code and Account Name to which they belong.

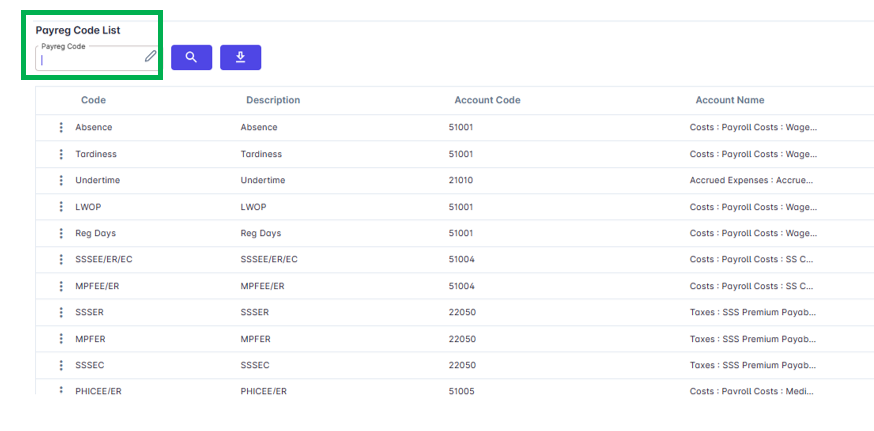

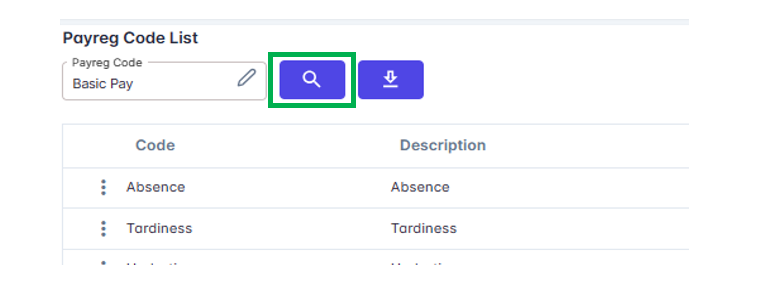

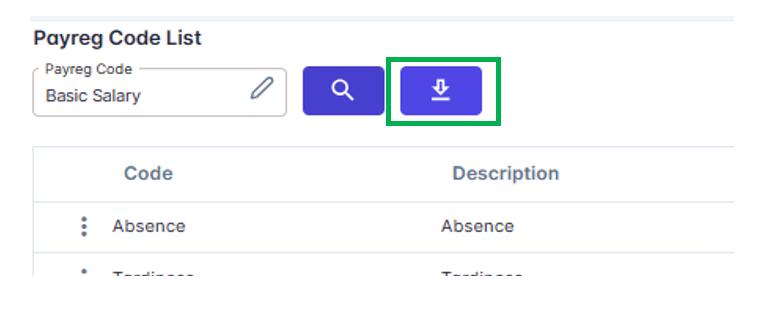

To view a specific Payreg Code>Input the specific code in the Payreg Code Box

Click search button.

To export all the list of Payreg Codes>click the Export button.

An excel file will be exported for the pay reg codes created.